The impact of T+1, cutting the settlement cycle to the day after a trade, and the increasing adoption of digital assets are having the most significant impact on the post-trade environment.

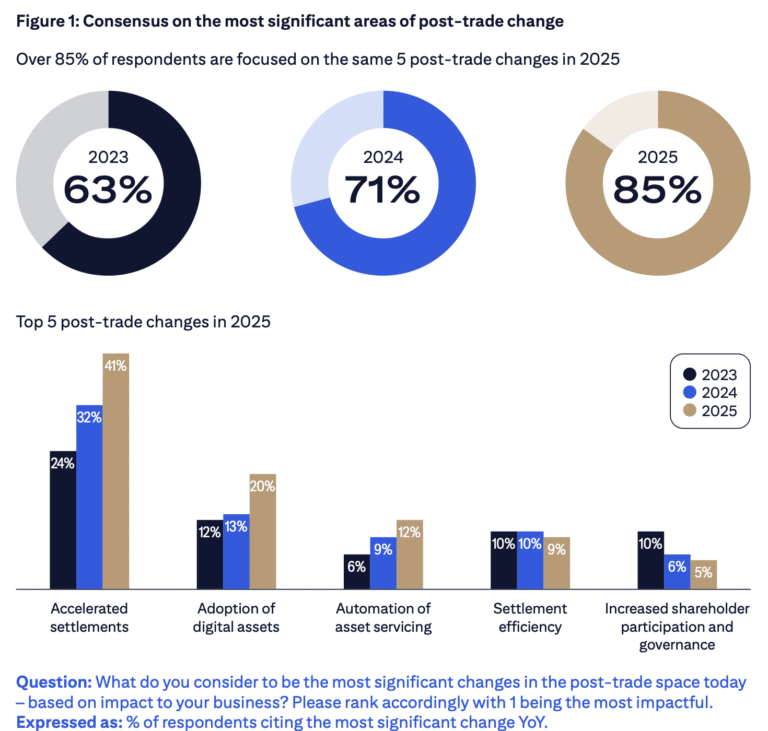

Citi’s latest Securities Services Evolution whitepaper found that 41% of respondents see T+1 as the most impactful marketchange, up from 32% last year. The bank surveyed 537 market participants from buy- and sell-side firms.

“As more markets have either confirmed or have indicated a timeframe to move to T+1 in the next four to five years, buoyed by the success of the 2024 migrations, global workloads are spiraling,” added Citi.

The paper said the cumulative workload of T+1 is larger than ever this year with three quarters, 76%, of respondents actively working on T+1 initiatives, especially among asset managers.

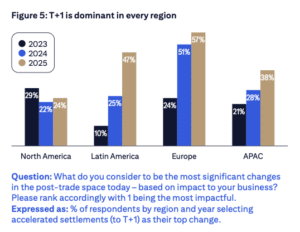

The U.S and Canada moved to T+1 in May 2024 but nearly half, 48%, of respondents to the survey are still running projects to optimize their internal processes for North American settlements. Citi said: “The impact of T+1 clearly extends well past implementation date. With levels of activity highest outside of the U.S., the effects of 2024’s transitions are still being managed by global firms across different time-zones and currencies.”

In addition, firms are also having to prepare for T+1 in European and Brazilian markets and scoping for potential transitions in Asia Pacific at the end of the decade. The UK, Switzerland, Liechtenstein and the European Union have all agreed to move to T+1 settlement on 11 October 2027 following the recommendations of their respective task forces and industry working groups. Brazil has decided to move to T+1 in early 2028.

Andrew Douglas, chair of the UK Accelerated Settlements Taskforce, said in the report: “T+1 is not the destination. It is a step on the way to faster and more automated settlements.”

Carlos Albuquerque, head of CSD at Brazil’s B3 exchange group, highlighted in the study that T+1 means that a central securities depository has to operate 24/7, or at least 21/5, to serve global investors.

“This transformational shift is creating new pressures on financial market infrastructures to transform their current process flows and platforms in ways that move well beyond T+1,” added Citi.

Digital assets

Digital assets and tokenized securities are expected to make up 10% of market turnover by 2030 according to the paper. Bank-issued stablecoins were identified as the main enabler to support collateral efficiency, fund tokenization and private market securities.

Citi said discussions about digital assets are now being led by business heads who want to realise immediate profits from tangible benefits, As a result, the majority of effort is focused on three core use cases where the business case is “clear and compelling” – tokenized collateral, stablecoins and fund tokenization. For example, 10.7% of total initial and variation margin is expected to be digitized in the over the counter market.

“More than half of the survey’s respondents are clearer than ever that the ability of DLT to increase the velocity of securities around the world’s capital markets can have major impacts on their funding costs, financial resource requirements and operating costs before 2028,” added Citi.