Innovation increases as the convergence of on- and off-exchange value propositions intersect. Historically, the exchange value proposition was access to the lit quote and speed, while ATS’s was access to midpoint liquidity with minimal impact. These lines have blurred as an increase in systematic approaches to trading has led to more innovation from all types of venues in order to attract liquidity and improve execution quality.

Systematic investors use structured, rules-based quantitative models and algorithms to make investment decisions. Joe Wald, co-head of electronic trading at BMO Capital Markets, told Markets Media: “Investors are looking for performance and execution quality and all types of venues are responding by trying to capture that execution.”

Wald explained that alternative trading systems (ATSs) used to be focused on midpoint execution in the dark while exchanges focused on speed and rebates for displayed liquidity. However, increased systematic trading has led to a confluence between venues with exchanges introducing dark strategies and ATSs launching new order types, and filing for protected quote status for their lit order books.

For example, Nasdaq’s midpoint extended life order (MELO) order type was introduced for clients seeking larger trade sizes at the midpoint and introduced a fixed holding period to gather order interest before application, and Cboe has brought periodic auctions from Europe to the US to source block-sized liquidity on-exchange. In addition, Wald described ATSs such as IntelligentCross as providing very good execution quality. In addition to relatively new venues like PureStream changing the paradigm of block trading with a parent-to-parent order matching trajectory cross and OneChronos Smart Market Expressive Bidding capabilities.

Wald said the Clearpool Algorithmic Managements System (AMS) gives broker-dealers the ability to connect to all venues and order types in a very nimble and fast way. In addition, the AMS’s ability for A/B testing allows BMO’s institutional electronic trading desk to collaborate with asset managers, providing data to measure algo performance when routing to different venues, with the winners being allocated more flows.

“Therefore, we can provide customized strategies where we have an edge, and pass that benefit onto the client,” he added. “There is a virtuous cycle where the more we are able to extract value out of venues and order types, the more competition and innovation comes into the space.”

In 2022 BMO Capital Markets introduced algorithmic trading in European equities as the Canadian bank believed it could gain market share due to its systematic approach to trading, market structure proficiency and modern technology. Wald said the same trends are evident globally in the US, Canada, Europe and across other regions.

“Over the last couple of years we have expanded from a regional player into a global player,” he added. “In every region, we will continue to be super-responsive to new venues and order types to incorporate them into the AMS, continuing to build up real-time analytics so that communication between our coverage teams and clients becomes more effective, and data driven.”

Growth in systematic trading

Wald said systematic trading is becoming more democratized as it is starting to be adopted by smaller asset managers. He added: “We are at a really interesting inflection point of that much bigger trend.”

Asset managers and brokers are facing greater pressure to automate their trading workflows as margins have reduced and consultancy Coalition Greenwich said in a report this year that adoption of equity-trading technology has increased due to dramatic innovation. Electronic trading has grown to 42% of U.S. and 44% of the European equity market commissions. In three years, managers expect this to grow to 48% and 50%, respectively according to the survey, Globalization of Algorithmic Equity Trading: A Buy-Side View.

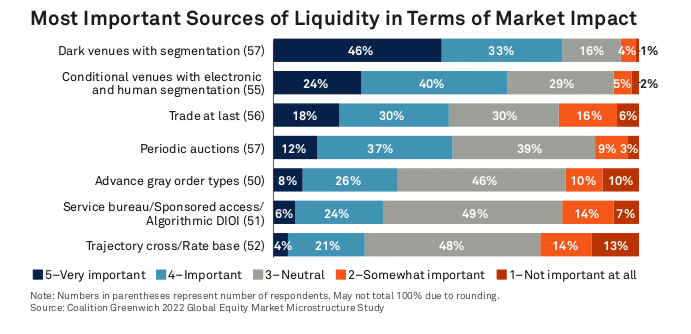

“Although there are some regional differences, most traders across North America and EU/U.K. agree to the broad strokes around some of the biggest challenges of algorithmic trading and the solutions to best navigate them,” added Coalition Greenwich. “For starters, the perennial issues around a lack of liquidity and venue fragmentation continue to stay top of mind as the greatest market structure challenges.”

Invesco said in its Global Systematic Investing Study 2023 that breakthroughs in data science and technology continue to dramatically enhance quantitative techniques. The fund manager interviewed 130 systematic investors responsible for managing $22.5 trillion in assets as at 31 March 2023.

The Invesco report said systematic investors are looking beyond factor investing, and that as volatility has increased they are using a broader range of quantitative strategies to target performance drivers across market cycles.

Respondents anticipated that AI will transform portfolio management in both monitoring investments, fine-tuning allocations and optimizing trading decisions with automation. An institutional respondent from APAC said in the report that they used AI modules to monitor investments and automate the timing of trading decisions, while a North American wholesale investor said the use of AI in execution has proven to be incredibly valuable.