In December 2023 TMX, the Canadian exchange operator, said it was acquiring the remaining 78% of US data, analytics and indexing provider VettaFi Holdings, for $848m.

Michelle Tran, president of TMX Datalinx, told Markets Media that buying the rest of VettaFi contributes to TMX Group’s long-term goal of increasing revenue from the Global Solutions, Insights and Analytics division. She added: “We also want to enhance our existing data products, content, analytics and our international footprint.”

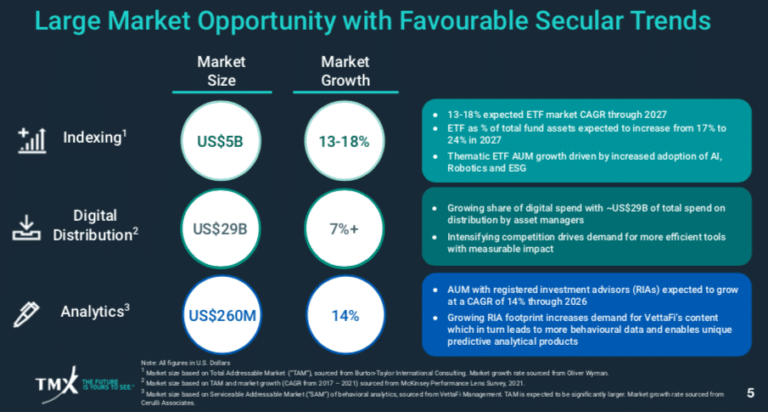

She continued that growth opportunities include further strengthening TMX’s position in the exchange-traded funds in Canada, and also growing in the ETF market overseas. For example, VettaFi’s index calculation engine provides data on more than 300 indices, which do not overlap with TMX’s existing suite.

TMX initially acquired a minority stake in VettaFi at the beginning of 2023. The group’s growth strategy is to build technology when it can, partner with specialist providers and also make acquisitions. Since the initial strategic investment John McKenzie, chief executive of TMX Group, and Jay Rajarathinam, chief operating officer of TMX Group, have sat on VettaFi’s board.

McKenzie said on TMX’s third quarter results call last October that the partnership was investigating how to use VettaFi’s index calculation engine to create new indices using TMX’s datasets and client relationships. He continued that TMX has unique Canadian datasets in equities, junior equities, fixed income, energy data through Trayport, as well as clearing data. In addition, TMX has launched an environmental, social and governance (ESG) hub and that data can be used to build up more ESG indices.

Tran added: “We had the privilege of working with VettaFi and found there were a lot of synergies, with very little overlap in capabilities. We loved working with them and went from a strategic investment to ownership.”

TMX also said in an investor presentation in December that VettaFi’S clients include 29 of the 30 largest ETF issuers and that more than $31bn of assets are tracking VettaFi indices. Clients include ETF issuers, mutual fund managers, structured product providers, and ecosystem service providers globally.

“This is a perfect match as VettaFi has a large number of international clients who will also benefit from TMX content,” Tran added.

“VettaFi also has digital distribution, so they are effective at amplifying an ETF issuer’s distribution to advisors, and we saw that in action in the US,” added Tran.

A full integration team is in place and Tran said the goal is to look at the process from a 100-day perspective.

“We don’t want to put the cart before the horse; we want to make sure we create solutions that clients want, such as ETF trends and flows,” she said.

The top priorities are to leverage both client bases, to understand the capabilities of the joint firm and to make clients aware of the opportunities. As an enterprise, especially with TMX Datalinx, the focus will be to add unique content and continue with partnerships, such as in ESG. For example, TMX also acquired Wall Street Horizon in 2022 and the firm’s corporate event data will be integrated in TMX Datalinx to create complete solutions.

Tran said: “Having more capabilities, the ability to respond proactively and a total solution will definitely help us to enhance our attractiveness to our clients.”

Competition

TMX has faced increased competition in Canada since Cboe Global Markets entered the country through acquisitions.

The US derivatives and securities exchange network acquired equities dark pool MATCHNow in 2020 and NEO, a fintech comprising a fully registered Tier-1 Canadian securities exchange, in 2022. MATCHNow migrated to the Cboe trading platform in 2022 and NEO is due to migrate to Cboe technology in the first quarter of 2025, subject to regulatory review.

In September 2022 the US firm introduced the Cboe One Canada Feed, its first data offering in the country. The Cboe One Feed provides reference quotes and real-time market data for equities.

In December 2023 Cboe Canada said in a statement it had received all necessary approvals to formally unify its Canadian operations by bringing together NEO Exchange and the MATCHNow alternative trading system (ATS) into one corporate entity under the umbrella of Cboe Canada, effective 1 January 2024.

Dave Howson, global president of Cboe Global Market, said in a statement: “While these entities have operated seamlessly as part of Cboe since the acquisitions, the formal amalgamation of our Canadian operations as Cboe Canada is a significant step towards solidifying our foothold in the region even further and laying the foundation for the continued growth of our business.”

Cboe said the unification aims to further strengthen Cboe Canada’s market position – where it currently accounts for approximately 15% of total Canadian equities trading market share – and is a part of its broader strategy to build a comprehensive equities offering encompassing trading, market data, access services, and listings.