The potential for tokenization via blockchain is approaching an inflection point and could reach up to almost $5 trillion in value by 2030 according to a report from Citi GPS.

The report, ‘Money, Tokens and Games: Blockchain’s Next Billion Users and Trillions in Value’, highlighted that blockchain is a back-end infrastructure technology without a prominent consumer interface, making it harder to see how it could be innovative, but the bank believes an inflection point is approaching.

$4-5 trillion of tokenised securities by 2030 & $1trn trade finance ???

Just launched our new GPS report on #blockhain #tokenisation

We assembled an Avengers A list on money, tokens & games ?https://t.co/1MAMhFsopI@SurendranNisha @davebarna #citidigimoney #citi pic.twitter.com/BrOfMF7Yom

— Ronit Ghose (@ronitA380) March 30, 2023

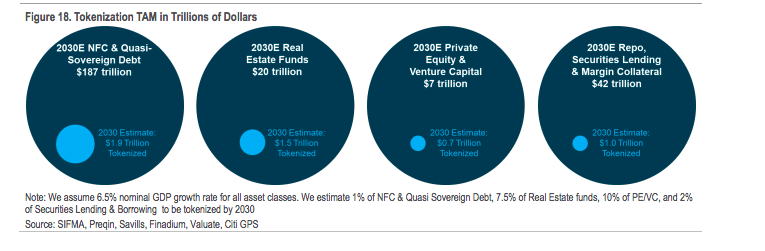

“Almost anything of value can be tokenized and tokenization of financial and real-world assets could be the “killer use-case” blockchain needs to drive a breakthrough,” added the report. “We forecast $4 trillion to $5 trillion of tokenized digital securities and $1 trillion of distributed ledger technology (DLT)-based trade finance volumes by 2030.”

Private market tokenization is expected to reach $4 trillion, with another $1 trillion from the repo, securities financing and collateral market by 2030.

Mass adoption is expected to be six to eight years away, but Citi GPS said momentum on adoption has shifted as governments, large institutions, and corporations have moved from investigating the benefits of tokenization to trials and proofs of concept.

Benefits of tokenization, especially for private funds and securities, include not requiring expensive reconciliations, cutting settlement failures, increasing operational efficiencies, fractionalization, and accessibility to a wider range of market participants.

Tokenization also allows monetization of illiquid assets such as art or real estate, provides new ways of financing infrastructure such as roads, heavy machinery, and allows small and medium enterprises to raise finance through direct-to-retail decentralized finance (DeFi) channels, and helps balance sheet efficiency by potentially reducing the amount of capital that needs be held and easing the collateralization process.

For example, the repo market transacts over $2 trillion in monthly volumes, but the market is still largely manual and inefficient. As a result, several new DLT-based digitization and tokenization initiatives have emerged including HQLAX, JPMorgan’s Onyx repo platform, and Broadridge’s DLT Repo to bring operational and capital savings to the industry.

“Given current industry momentum, it seems feasible that digital collateral markets could become the first scaled use cases for digital tokenized securities flows,” said the report.

Citi GPS envisages the end state of a digitally native financial asset infrastructure, globally accessible, operating 24x7x365 and optimized with smart contract and DLT-enabled automation capabilities, which enable use cases impractical with traditional infrastructure.

“New product features could range from debt instruments paying daily, hourly, or even by the minute cash flows to embedded live environmental, social, and governance (ESG) tracking in any security, to flexible tailor-made funds based on each client’s investment profile or philosophy,” added the study.

Institutional adoption

However there is some scepticism and adoption has been held back by the lack of an established legal and regulatory framework to support tokenized instruments. In addition new technological infrastructure needs to be built and some existing players could be disintermediated.

The industry also needs standards and interoperability as financial market infrastructures (FMIs) and consortiums are working on the same problem in parallel, but with no clear interoperability or standardization.

“In the context of applying public blockchain to FMI, transaction speed and throughput, liveness and data availability, and transaction level privacy are important for institutions,” added the report. “These are, however, only growing pains and will pass as the ecosystem matures, the technology develops, and adoption grows.”

Citi GPS gave examples of disruptive technology which have previously been through this cycle such as electrification, the internet and SWIFT electronic messaging. However, there will also be failures and Citi GPS highlighted the Australian Securities Exchange’s project to replace its settlement platform CHESS with a DLT-linked alternative. However, The project has been delayed and the ASX has written off $165m in investment.

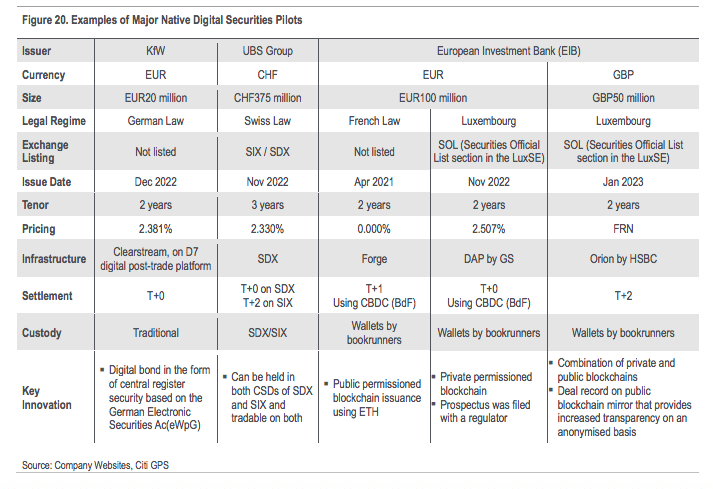

A panel discussed the institutional adoption of digital assets at Citi’s 10th Annual Digital Symposium in London on 30 March. In October last year Clearstream, a subsidiary of Germany’s Deutsche Börse, created the first instrument on D7, its digital post-trade platform.

Historically, German securities had to be issued as paper-based global notes and stored in a physical vault at the central securities depository. In 2021 the German regulator passed the electronic securities act, allowing dematerialised issuance and since December of that year Deutsche Börse has been processing dematerialised securities via a central register, the first live D7 component.

Jens Hachmeister, managing director, issuer services & new digital markets at Deutsche Börse, said on the panel that the group had spent 12 to 18 months working with the key issuers on how to create value in their market segment.

“The discussion didn’t have anything to do with the type of technology but how to take markets to the next level of efficiency,” said Hachmeister.

In order to issue digital securities, the Germany regulator had to allow the digitisation of bearer bonds under the Securities Act, and Deutsche Börse partnered with fintech Digital Asset to build the use case.

Deutsche Börse has also invested in HQLAX, and again, Hachmeister said the group started with questioning how to improve the mobilization of collateral and add value to the market, before deciding on the appropriate technology. Hachmeister believes that DLT will be one of multiple technologies that will be important in the digital asset space.

“In my view, currently, I sometimes think that we approach the market too much from a technology angle,” he said.

The panel highlighted the need for interoperability and Adrien Treccani, founder and chief executive of digital asset custodian Metaco, said standards are necessary but are very slow to evolve.

“Everyone will build different ways of operating an equity or bond token but the ecosystem needs to converge to certain standards,” said Trecanni. “Metaco is very much pushing banks to align on certain ways of doing things.”

For example, agreement is needed on transfer networks, meeting compliance requirements, netting of trading and settlement, collateral management, which he expects to take multiple years.

Hachmeister argued that there is too much focus on technical standards, and we need to start with market standards and work backwards towards technology standards and interoperability. He expects an increase in complexity in the short term.

“If you look at the music industry at the time when the CD was invented, you initially kept your old record player,” he said. “When we went on to streaming you keep your CDs and this will be a similar kind of transformation as we operate and develop infrastructure in parallel for a certain period of time.”