The total market value of tokenized real world assets has crossed $20bn, according to Securitize, the tokenization platform.

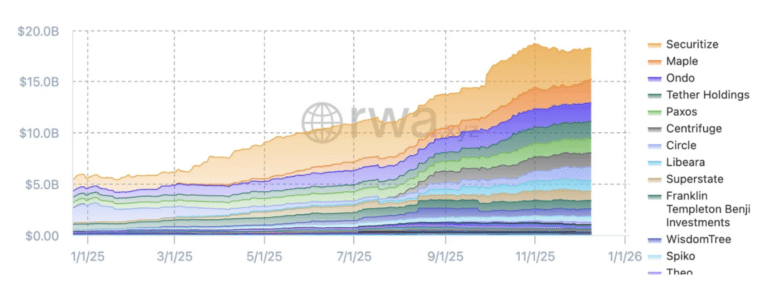

In its review of 2025, Securitize said the tokenized real world asset market (excluding stablecoins) grew to $18.2bn by the end of the year, compared to approximately $5.5bn at the start. Tokenized treasuries increased from $4bn to $9bn over the same period.

“Tokenized assets grew from a promising category into one of the fastest expanding segments of global finance,” added Securitize.

On 11 January 2026, Securitize said this market had grown to more than $20bn.

The total RWA market value has officially crossed $20B.

Tokenization is accelerating. pic.twitter.com/nr7G3ULumZ

— Securitize (@Securitize) January 11, 2026

BlackRock used the Securitize platform to launch its tokenised money market fund, BUIDL, in March 2024. One year later, BUIDL became the first tokenized fund issued by a Wall Street institution to surpass $1bn in assets under management, according to Securitize. In November, crypto exchange Binance announced that BUIDL will be accepted as off-exchange collateral for trading.

“Tokenized treasuries had entered the global margin system,” added Securitize.

By the end of 2025 BUIDL reaching became the first tokenized fund to reach $100m in daily dividends distributed according to Securitize.

In May last year another traditional fund manager, VanEck, also launched its first tokenized fund, VBILL, on Securitize.

In November, VBILL was integrated as Aave’s institutional-grade real world asset market as eligible collateral.

Securitize said: “Through this integration, qualified institutions can now borrow stablecoins directly against their VBILL holdings, turning tokenized treasuries from static, yield-bearing instruments into onchain collateral.”

In addition to tokenized money markets, Apollo launched ACRED on Securitize in January 2025 to offer tokenized access to the asset manager’s diversified credit fund. The strategy invests across corporate direct lending, asset-backed lending, and performing, dislocated and structured credit.

“ACRED showed that private credit could go onchain,” said Securitize.

In six months ACRED surpassed $100m in asset under management. In November last year Loopscale, an onchain credit protocol, allowed accredited investors to borrow fixed-rate against ACRED.

“This could be considered a preview of the emerging liquidity ecosystem around tokenized private credit,” said Solona. “These milestones made 2025 the breakout year for institutional onchain credit.”

BNY and Grove Finance also partnered with Securitize to launch STAC, the first AAA-rated tokenized collateralised loan obligation (CLO), which Securitize described as a “major moment” for structured credit onchain.

Guy Wuollet, general partner at Andreessen Horowitz focusing on infrastructure and application layer investments across crypto, said in a blog that the venture capitalist has seen strong interest from financial institutions to bring U.S. equities, commodities, indices, and other traditional assets onchain.

“As more traditional assets come onchain, the tokenization is often skeuomorphic — rooted in the current idea of real-world assets, and not taking advantage of crypto-native features,” he added.

He argued that synthetic representations of assets like perpetual futures (perps) allow deeper liquidity and are often simpler to implement.

“It all comes down to the question of “perpification vs. tokenization”; but either way, we should see more crypto-native real world asset tokenization in the coming year,” said Wuollet.

Alex Thorn, head of firmwide research at digital asset investment manager Galaxy, said in his predictions for 2026 that the U.S. Securities and Exchange Commission will grant some form of exemptive relief for expanding the use of tokenized securities in decentralized finance (DeFi).

“This will allow for the growth of legal, non-wrapper onchain securities into DeFi markets on public blockchains, not just the use of blockchain technology for back-office capital markets activity,” Thorn added.