The cross pollination between traditional finance (TradFi) and decentralized finance (DeFI) has only just begun as digital asset investment products had record inflows in 2024.

Research provider Coalition Greenwich said in its Top market structure trends to watch in 2025 that traditional firms are introducing access to TradFi assets via DeFi mechanisms. Traditional investors can trade crypto via exchange-traded funds, futures and options to gain access to the asset class though their existing accounts. In the other direction, DeFi investors can earn yield in on-chain stablecoins backed by a huge asset manager holding U.S. government debt.

*New report*In what promises to be an unpredictable year ahead for financial markets there are a few things everyone can count on: Trading will continue going electronic, workflows will continue automating, markets will continue becoming more transparent…https://t.co/yA8NetyT8E

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) January 6, 2025

For example, Frax Finance, a decentralized stablecoin cryptocurrency protocol, launched a stablecoin backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) this year. BlackRock’s tokenized fund invests in cash, US Treasury bills, and repos.

“Whether or not all of finance moves toward DeFi in the decade ahead or these two worlds ultimately coexist with more seamless linkages is too hard to predict,” added Coalition Greenwich. “But the TradFi–DeFi love affair has certainly only just begun.”

Digital asset investment flows

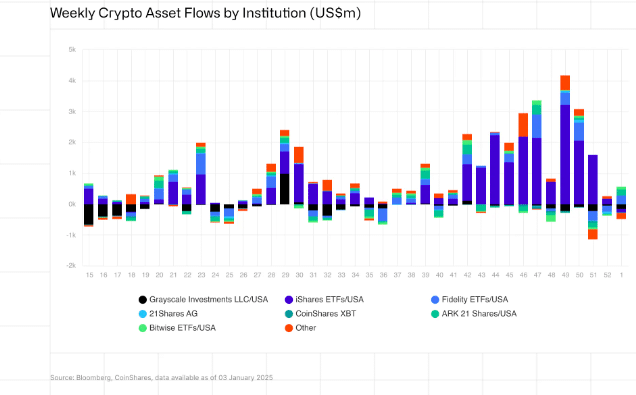

In 2024 there was a record $44.2bn of inflows into digital asset funds globally, almost four times the prior record set in 2021 according to research provider CoinShares.

James Butterfill, head of research at CoinShares, said in a report that Bitcoin dominated inflows in 2024 with $38bn inflows representing 29% of assets under management, while ethereum saw a resurgence late in the year bringing full year inflows to $4.8bn.

“Although other countries saw inflows such as Switzerland at $630m, this was offset by large outflows from Canada and Sweden at U$707m and $682m respectively as investors switched to US-based products and in some cases took profits,” he said.

In the first three days of this year digital asset investment products had $585m of inflows according to Coinshares.

Coalition Greenwich predicted that more crypto-related ETFs will bring an increase in crypto-ETF options volume. In addition, Coalition Greenwich expects that US crypto markets will see a lighter regulatory touch under the new administration and gain regulatory clarity;