The UK, Switzerland and the European Union have published plans to shorten their settlement cycle by one day to T+1, the day after a trade. The U.S and Canada moved to T+1 in May 2024 and DTCC, the country’s central post-trade infrastructure, said the UK and EU reports are complementary and have notable similarities, but there are also several important differences in their approaches.

The North American move to T+1 in May 2024 was perceived as “relatively smooth” according to a report in June this year from consultancy Firebrand Research, led by Virginie O’Shea.

The report, Tackling Post-Trade Friction, Supporting a Global Shortened Settlement Cycle, said: “Post-implementation reviews have highlighted some areas in need of more focus such as foreign exchange, fund settlement cycles and further automation across the post-trade lifecycle.”

Phil Flood, global business development director – regulatory and straight-through processing (STP) services at Gresham, which provides enterprise data automation solutions for the financial services industry, told Markets Media that some European firms did increase automation when the U.S cut its settlement cycle. However, the overall market impact was more limited than expected as many firms responded by throwing more people at the problem.

Flood said: “We still see firms using manual processes and receiving batch files without real-time API integration. The move to T+1 should be an impetus to change.”

Firebrand agreed on the need to automate as many processes as possible to enable straight-through processing.

“The relatively static failure rate within the US market both pre- and post-T+1 implementation indicates that there is still room for improvement in terms of automation within that market,” added Firebrand.

In the North American markets affirmation and allocation processes were completed on trade date to ensure any issues could be resolved before the settlement deadline. Firebrand said the European markets have a different model where they reach matching finality at the central securities depository.

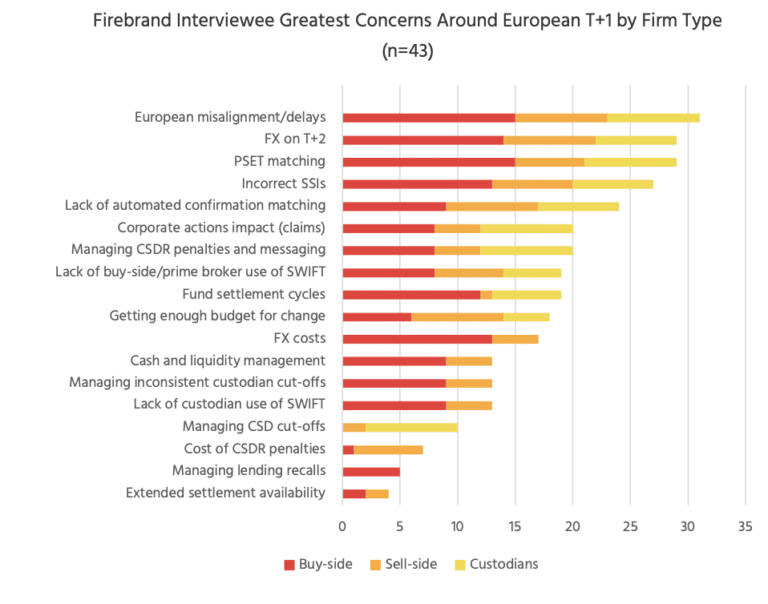

The consultancy’s survey found that the need for greater levels of automation in confirmation and allocation matching was cited by more than half, 56%, of firms in. their concerns about the migration to T+1.

The biggest concern was the potential misalignment of European markets due to the fragmented post-trade landscape in Europe with different processing schedules, tax systems, business models and legal frameworks to navigate in 27 EU jurisdictions.

Roadmaps

The UK, Switzerland, Liechtenstein and the EU have all agreed to move to T+1 settlement on 11 October 2027 following the recommendations of their respective task forces and industry working groups.

Matt Johnson, executive director for ITP industry relations at DTCC, said in a blog that the UK Accelerated Settlement Taskforce implementation plan was published in February this year and emphasised the need for automation in achieving timely settlement.

In June this year the EU T+1 Industry Committee published its T+1 recommendations which included focus areas such as standardization of processes, enhancing technology and infrastructure, and the need for regulatory support. The EU T+1 roadmap is open for consultation until the end of August 2025.

John Siena, associate general counsel and co-head of regulatory strategy at financial services group BBH, member of the EU T+1 Industry Committee and the UK Accelerated Settlement Taskforce, said in a statement: “By achieving this milestone in just five months we are making a statement of absolute commitment to work with public authorities and others across the industry to modernize and improve capital markets across the EU/EEA.”

Johnson said similar recommendations in the EU and UK reports are encouraging – and are clearly the result of significant coordination between authorities, the respective taskforce chairs and the industry. He added: “While faster settlement promises greater efficiency, it is clear the industry’s ability to implement automation and optimise post-trade processes will be critical to achieving a smooth, seamless and successful transition.”

He highlighted that both reports focus on automation, with alignment on same-day allocation/confirmation; broad alignment on what is in scope for T+1 and a commitment to readiness testing in January 2027. However Johnson also said there are important differences in approach such as “gating events” which occur after trades are executed and the management of standard settlement instructions (SSIs).

“While a key question remains open around the possibility of industry-wide external testing, there is certainly an appetite for joint and coordinated testing between jurisdictions,” added Johnson.

Testing

Flood highlighted that DTCC starting testing very early during the U.S migration to T+1 was essential to its success. Firebrand Research agreed that the industry needs to begin testing as early as possible so that any problems can be addressed ahead of the ‘go live’ date of October 2027.

“One of the areas in which the North American transition could have been improved, according to industry participants, is the amount of time and focus given to the functions outside of the equities settlement process,” added Firebrand.

For example, more attention could have been paid to corporate actions, foreign exchange, mixed basket fund settlement and the impact on the overseas investor community according to the report. The Firebrand survey found that 28% of respondent firms have not started planning for T+1.

“We are very much in the early stages of T+1 In UK and Europe,” added Flood.

He expects market participants to already be holding strategy sessions or stakeholder meetings to gather all the information required to create an action plan for next year.

“Firms should know their landscape by the end of 2025 so they know where the pain will be,” Flood added. “2026 will be a year of activity.”

Firebrand said firms have not yet put together proper cost estimates for the European move to T+1 as most are at very early stages of planning. The consultancy has estimated that the top end costs for global custodians could sit at around $36m for those that have a large client base and multiple post-trade systems to update.