big xyt, the independent provider of market data analytics and smart data solutions, is aiming to expand its US client base after hiring Jenny Chen from Société Générale where she was head of global execution services.

Based in New York , Chen has joined big xyt as managing director, head of sales in the Americas.

Chen told Markets Media: “I have spent my entire career on the execution side and have seen the evolution of electronic trading and the need for accurate data and smart analytics. As result, it has been a natural transition into fintech, leveraging more than 17 years of sales and leadership experience.”

Before Société Générale Chen worked at Goldman Sachs and UBS and in 2018 she won the Market’s Media “Excellence in Multi-Asset Trading” Women in Finance Award.

She continued that big xyt has existing relationships with all major European exchanges and that global banks and buy-side firms are using the European flagship products such as the Liquidity Cockpit dashboards which provide a consolidated, normalized view of all major regulated markets, multi-lateral trading facilities (MTFs) and systemic internalisers.

The firm’s transaction cost analysis suite, Open TCA, stores, retrieves, and analyzes large data sets on-demand to answer clients’ most relevant questions on execution.

“We are, however, further expanding our client base into the US, including asset managers, passive fund managers, quant funds, hedge funds, and pensions,” Chen added.

She said big xyt will differentiate itself by providing a holistic approach to tailor the solution to each client’s business needs.

“The technology architecture is both User Interface and API-driven so it is very flexible and easy for clients to connect to and use,” Chen said. “The service model is to provide a low-touch technology product with high-touch client service.”

In Europe the MiFID II regulations strengthened best execution requirements and extended them from equities into other asset classes. Chen said US regulators are also focussing on best execution.

“Best execution used to be a ‘tick in the box’ but MiFID II has led the buy side to look more closely at execution and smarter way of trading,” she added. “In the US, under SEC & FINRA’s best execution practices, clients have a need for greater transparency on routing destination and venue analysis.”

US best execution

In the US a new SEC requirement, Rule 606(b)(3), came fully into effect this year. The regulation requires brokers to provide trade data to clients upon request so institutional investors can review order routing and assess execution quality.

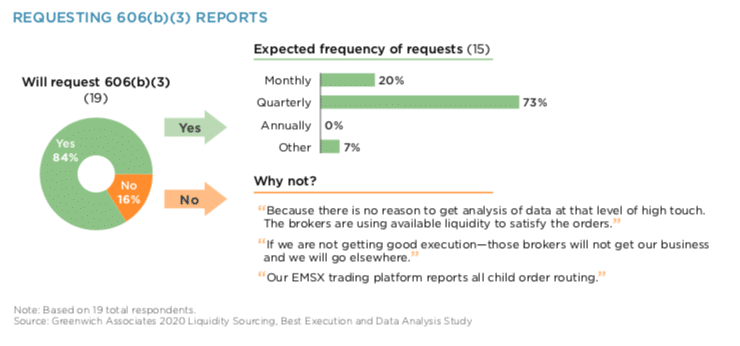

A survey from consultant Greenwich Associates on the new rule found that nearly all buy-side firms, 84%, plan to request 606(b)(3) reports, generally on a quarterly basis, 73%.

“If a broker is unable to provide the requested data, not only will they be subject to regulatory oversight, institutions are also likely to penalize them with reduced volume,” added the report.

In addition just above one third, 37%, of the buy-side firms said they expect the new data to be important or very important to how they analyze their downstream trading according to the report, Rule 606(b)(3) and Beyond: The Ever-Evolving Search for Good, Better and Best Liquidity.

Shane Swanson, senior analyst for Greenwich Associates market structure and technology, said in the report: “Larger firms have often already instituted integrated programs to analyze execution outcomes at a fine level of detail. The fact that these large firms were able to get such unfettered access when others might not get any data is one of the reasons that Rule 606(b)(3) was promulgated in the first place.”