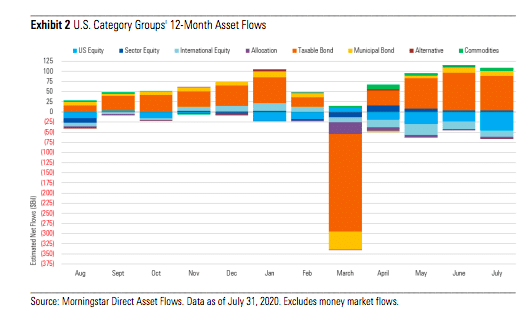

Year-to-date outflows from U.S. equity funds’ put the group on track for its worst ever annual outflows according to research from Morningstar, the asset management research and data provider.

The report, Morningstar U.S. Fund Flows: Equity Funds’ Pain Mounts in July, said U.S. equity funds had $147bn (€124bn) of net outflows in the first seven months of this year, surpassing the record outflows of $63bn in 2015. International equity funds’ net redemptions of $63bn so far in 2020 is also ahead of the record of $53bn in 2008.

However, long-term mutual funds and exchange-traded funds gathered $43bn last month, their fourth consecutive month of inflows, and investors are also investing in taxable-bond funds.

“Total inflows from April through July were $164bn, just more than half of the $327 billion of outflows those funds suffered in March,” said the report.

Morningstar continued that with taxable-bond funds doing so well, there is no evidence of the so-called “great rotation” from bonds into stocks.

“U.S. equity funds had record outflows of nearly $46bn in July,” added the report. “While actively managed funds continued to bear the brunt of those redemptions (to the tune of $27bn), their passive counterparts also shed nearly $19bn during the month.”

The research highlighted sector equity funds, such as technology and health, as a rare bright spot that could benefit from social distancing policies, remote working, e-commerce and the search for a coronavirus vaccine.

“Tech funds took in more assets than any other equity category in July,” said Morningstar. “But investors dropped out of sectors hit hard by government-imposed lockdowns or weak demand, including real estate and natural resources.”

High-yield funds

In contrast to US equity funds, data provider Refinitiv Lipper’s corporate debt-high yield group’s net intake of $14.1bn for the third quarter to date has the potential to be its second-best quarterly result.

“After suffering steep net negative flows in the first quarter (-$14.2bn) as investors reacted to COVID-19, the group has rallied with its best quarterly net inflow ever in the second quarter (+$41.5bn),” said Refintiv. “After taking a huge coronavirus induced loss in Q1 (-12.8%), the group has come roaring back.”

Refinitiv #Lipper Chart of the Week: Fund investors continue to flock to below investment-grade corporate debt: https://t.co/z8pNTcWtVh @PatrickKeon1 pic.twitter.com/X3BDkW95fk

— Lipper Leaders – Refinitiv (@LipperLeaders) August 17, 2020

Refinitiv continued that the group has regained almost all its first quarter losses and is now down just 0.5% for the year.

Since the end of the first quarter, the majority of the net inflows for high yield funds have been in mutual funds, $33.8 bn, while ETFs have contributed $21.8bn in net positive flows.

“The largest individual net positive flows over this time period belong to an ETF, as the iShares iBoxx $ High Yield Corporate Bond ETF has taken in $13.7bn of net new money since the end of March,” added Refinitiv. “Three of the next four largest net inflows did belong to mutual funds.”

European ETFs

Detlef Glow, head of EMEA research at Lipper said in a report that July was another positive month for the European ETF industry since promoters enjoyed inflows as markets stabilized after the coronavirus induced economic downturn.

The European ETF industry seems to be back on track after the turmoil caused by the corona crisis. Read more about the trends in the ETF market in my latest Monday Morning Memo on @Lipper_alpha Insight: https://t.co/Dmrjzyr1YD #MondayMM @LipperLeaders

— Detlef Glow (@DetlefGlow) August 17, 2020

‘The combination of above average inflows and the positive performance of underlying markets led to an increase in assets under management from €830bn as of June 30, 2020, to €843.5bn at the end of July,” added Glow.

Equity funds held the majority of assets,€551.5bn, followed by bond funds at €254.8bn.