US companies’ environmental, social and governance performance tends to have a negative relationship to stock returns, although more sustainable firms had higher resilience and lower losses during the COVID-19 pandemic.

Dr Svetlana Borovkova, head of quantitative modelling, and Ying Wu analysed data provider Refinitiv’s combined ESG scores for large-cap firms and their financial performance for more than 2,000 companies between 2010 and 2018.

For each company it covers, Refinitiv collects 450 ESG-related metrics and 186 are used to create E, S, G and the overall ESG scores. They reviewed whether stock returns, market value and volatility of large-cap firms in four regions – EU, US, Australia and Asia (Japan, China and South Korea) – were related to their ESG performance. The stock universe is the set of constituents of the S&P 500, STOXX 600, Australia ASX 300, Japan Nikkei 500, China A-share and South Korea KOR 200 indices.

They concluded that investors in European Union and Australian firms do not sacrifice their returns by investing in highly ESG scoring firms.

The report said: “This is arguably a result of the EU and Australia leading institutional investors’ embrace of ESG, and actively incorporating sustainability in their portfolio management considerations.”

EU stocks with higher ESG scores significant enhanced returns. “We observe that, for EU firms, there is a significant negative relationship between the market value and the excess return, suggesting that smaller EU companies generate higher returns on average,” added the study.

In contrast, for US and other Asian firms there was a significant negative relationship between the ESG scores and excess returns. The authors said this could arguably be a result of less focus on sustainability in the US, leading to lower demand by investors than in the EU.

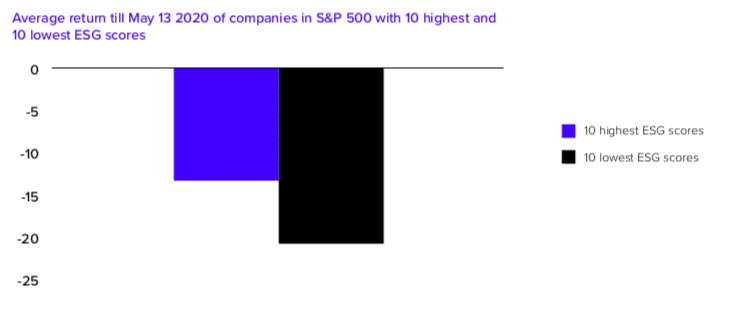

“This seems like a bad news for sustainable investors in US firms,” added the report. “However, zooming in on the resilience of more sustainable US firms during recent COVID-19 crisis, it appears that they were able to weather this storm much better than less sustainable US companies.”

Between January and May this year, top 10% ESG scoring firms losses were only two-thirds of the losses encountered by bottom 10% of firms, particularly in utilities, materials and health care.

Size and volatility

The study found that the most pronounced effect is the correlation between the ESG score and the size of a company – which is positive and significant for all years and all regions.

“This shows that larger firms tend to exhibit better ESG performance, as they have more means to invest in sustainability issues,” added the report. “This must be considered when implementing ESG criteria in investment strategies, as improving ESG scores of a portfolio can introduce an (undesired) size effect and tilt the portfolio towards larger firms.”

There were significant negative correlations between the ESG score and volatility of returns for firms in all four regions indicating that more sustainable firms tend to have more consistent and less volatile financial performance.

ETFs

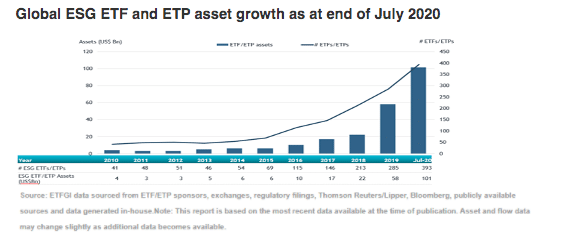

In the exchange-traded fund market, ESG funds listed globally reached a record at end of July this year according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem.

ETFGI reported that net inflows into ESG funds was a record $38.8bn in the year to July, which is higher than the $26.7bn gathered in all of 2019. The flows helped total assets invested in ESG ETFs and ETPs reach $101bn by the end of July.

European domiciled ETFs/ETPs accounted for 51.6% of overall assets followed by products domiciled in the US which account for 40.1% of the overall assets.