VanEck, the US asset manager, said it will soon launch an actively managed exchange-traded fund investing in ether futures as open interest in crypto derivatives has continued to increase.

The fund manager said in a statement that the ETF will not invest directly in digital assets. Instead, the ETF will invest in standardized, cash-settled ether futures contracts traded on commodity exchanges registered with the Commodity Futures Trading Commission, which is currently only CME Group.

More hints that #Ethereum futures ETFs are happening sooner than expected. https://t.co/0LHx7UIBYD

— James Seyffart (@JSeyff) September 28, 2023

The fund (EFUT) will be listed on Cboe and actively managed by Greg Krenzer, head of active trading for VanEck.

“EFUT joins the VanEck Bitcoin Strategy ETF (XBTF) in providing futures-focused exposure to key digital assets,” added VanEck.

The US Securities and Exchange Commission has only permitted bitcoin futures ETFs, and has so far rejected all the applications for spot bitcoin ETFs. However, in July this year VanEck was one of the asset managers that applied for a spot bitcoin ETF alongside BlackRock, Fidelity, Invesco Galaxy and WisdomTree.

Crypto futures volumes

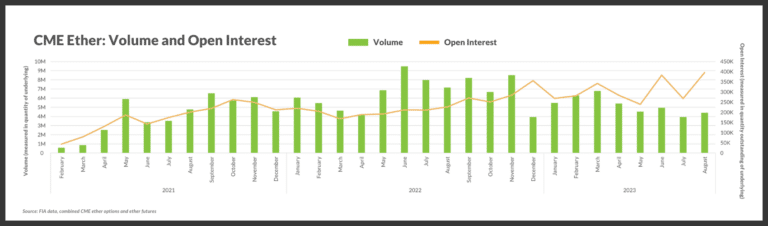

FIA, the trade organisation, said in a blog that the CME had a 154% year-over-year increase in volume across its bitcoin futures and options, and an 87% rise in open interest, between January and August.

CME’s ether futures and options also hit a record level of collective open interest when compared with the first eight months of 2022 to 2023.

“In fact, open interest in CME’s ether futures and options just hit an all-time high in August – eclipsing the prior high recently set in June,” added FIA. “CME’s record open interest across bitcoin futures and options came earlier this year in March, but still shows a long-term uptrend.”

In July CME reported higher volume and open interest across its crypto futures and options.

The exchange said it set the following records the second quarter:

- Bitcoin futures – ADV: 10.8K contracts (+1% vs. 2022). OI has averaged a record 14.8K contracts (+15 vs. 2022).

- Bitcoin options – ADV: 345 contracts (+132% vs. 2022). OI has averaged a record 9.4K contracts (+175% vs. 2022).

- Micro Bitcoin options – ADV: 504 contracts (+28% vs. 2022). OI averaged a record 5K contracts (+7 vs. 2022).

- Ether futures – OI averaged a record 4.3K contracts (+6% vs. 2022).

- Ether options – ADV: 70 contracts (+268% vs. 2022). OI averaged a record 1.6K contracts (+338 vs. 2022).