The CBOE Volatility Index (VIX) has traded barely in the teens for much of this year. Compared with more-typical levels in the upper teens, 20s and 30s over the past few years, the so-called fear gauge is signaling complacency about market moves ahead.

One major factors that has impacted markets and the VIX value in the past year is the world’s central banks’ vigorous efforts to stimulate growth and mitigate risk. Therefore, “most in the market are less willing to pay up for the volatility exposure, and the cost of owning volatility today is substantially lower than in the five-year period from 2007 to 2012,” said Don Dale, managing partner at Derivaguard Advisors.

Still, by definition volatility should be volatile, and market participants who stick with this view may be rewarded.

“People who aren’t using VIX as an asset class are going to, at some point in the future, wish they had,” said CBOE Options Institute Senior Instructor Russell Rhoads, CFA. “While the absolute value of VIX tells us there is not a lot of concern about sharp moves in the overall market, we are seeing higher volumes in volatility futures and options contracts.”

Average daily volume for VIX options trading in the first quarter reached a record 637,000 contracts, up 42% from year-earlier levels. For VIX futures, average daily volume is close to 155,000 contracts and did not fall below 100,000 in the first quarter. Rising volumes confirm the increasing importance of volatility as an asset class, according to Rhoads and CBOE trader sources.

Rather than speculating in VIX contracts and derivatives, some institutions are allocating a monthly hedge in out-of-the-money VIX call options. With that, they gain a lot on a 5% to 10% up or down move in the S&P 500 in a short period of time.

Some hedge funds are barren of volatility assets and are set up precisely to profit from a completely unforeseen and sizable down move, such as the Lehman collapse. Unfortunately for them, the DJIA turnaround from the March 2009 swoon below 6,500 and ensuing run-up to new record highs exceeding 14,673 this week dragged the ‘tail risk’ strategy performance of these so-called ‘black swan hedge funds’ into the red for the past three years as the market rally worked against them.

Studies show that volatility remains as a trader’s go-to diversifier relative to big market draw-downs, and is important to hedge against what could be dire risk. The key example of 2008’s third quarter showed all assets came under pressure together. Balanced portfolios were fooled. VIX was the exception.

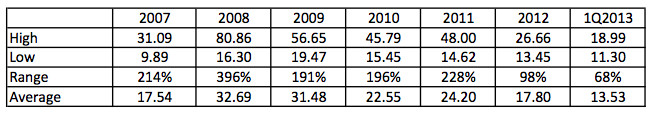

The table shows the average close for VIX, closing high, closing low, and the high-low range for VIX in the years 2007 through 2013 YTD.