Will Peck, head of digital assets at asset manager WisdomTree, said stablecoins represent a “massive opportunity” as stablecoins evolve beyond niche use in crypto trading and decentralized finance (DeFi)

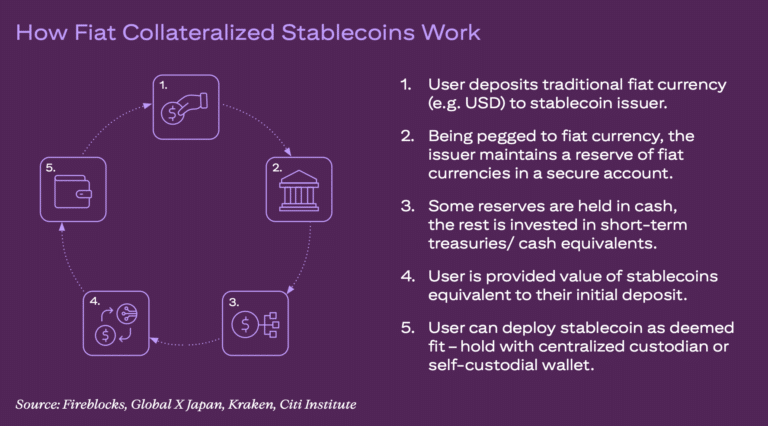

Stablecoins are a cryptocurrency that aims to maintain a stable value by pegging their market price to a reference asset such as a fiat currency, most commonly the U.S. dollar, a commodity or a basket of financial instruments. Fiat-backed stablecoins maintain their peg by ensuring each issued token is redeemable for an equivalent amount of fiat.

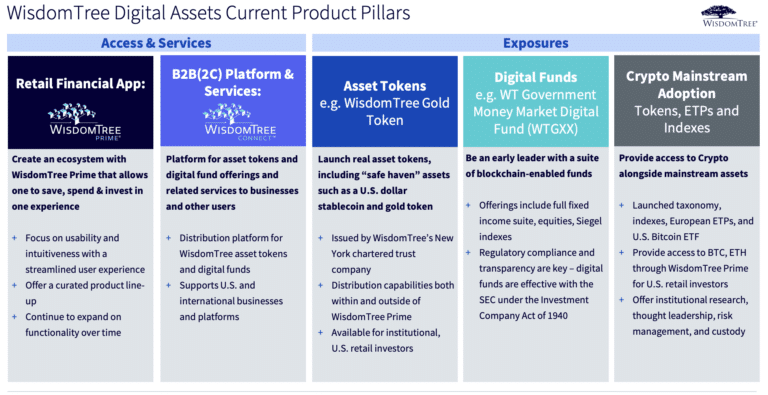

WisdomTree has issued USDW, a U.S. dollar stablecoin for transactions and WTGXX, a tokenized U.S. government money market fund for yield.

USDW currently functions as the dollar payment rails on WisdomTree Prime, the firm’s direct-to-retail app for digital assets. Peck told Markets Media that USDW is a transactional asset for tokenized finance and can move value onchain across WTGXX, equities, fixed income and asset allocation strategies.

U.S. dollar backed stablecoins have been dominated by USDT, issued by Tether, and USDC, issued by Circle, which has become a public company. WisdomTree has built a stablecoin interoperability layer, enabling clients to on- and off-ramp using USDC, and Peck said the firm has already facilitated more than $200m in USDC payments. He argued that the industry will need different stablecoins for different use cases.

USDW operates on the Stellar blockchain in WisdomTree Prime and Peck said the firm intends to expand to other blockchains and user groups to enable more use cases and accelerate adoption.

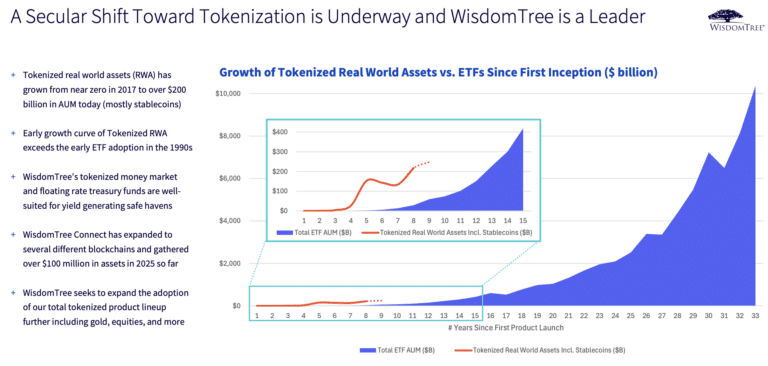

WTGXX is one of 13 WisdomTree tokenized funds that provide access to real world exposures in an onchain format and investors can receive dividends in USDW. Peck said WTGXX has grown from $12m to $486m as at 18 July 2025, especially as it has been adopted as a reserve asset for stablecoin issuers.

“Both the GENIUS Act and New York Department of Financial Services guidance specify high standards for reserve assets – standards that many alternatives don’t meet,” said Peck. “As a 1940 Act-registered money market fund, WTGXX can qualify as a reserve asset under these standards.”

As a regulated fund, WisdomTree has to identify WTGXX holders, which the firm does by tagging their wallet at WisdomTree. These authorised WisdomTree wallets can make peer-to-peer WTGXX transfers onchain 24/7, which allows for DeFi transactions such as collateralized loans. In addition, there has been interest from corporate treasuries in using WTGXX, and in using the tokenized fund as collateral according to Peck.

WisdomTree is working on the ability to trade WTGXX in real-time 24/7/365 against stablecoins so issuers have the confidence to manage liquidity around the clock.

“The implication is clear: stablecoins are evolving beyond niche use in crypto trading and DeFi,” added Peck. “That evolution is already underway, and it represents a massive opportunity.”

Peck said that with USDW, WTGXX, a growing suite of tokenized exposures, on- and off-ramps and other services, all delivered via APIs, WisdomTree is building an integrated platform to serve this ecosystem across multiple dimensions.

Jonathan Steinberg, chief executive of WisdomTree, said in the first quarter results: “With over $100m of inflows into our tokenized products year-to-date and the most extensive suite of tokenized real-world assets in the market, WisdomTree is proving its leadership in digital asset innovation. As we expand AI across our global platform and digital adoption accelerates, we are positioned to drive lasting value and lead the future of asset management.”

GENIUS Act

Dovile Silenskyte, director of digital assets research at WisdomTree, said in a report that the passing of the GENIUS Act for regulating stablecoins on 18 July 2025 represents a seismic shift in macroeconomic policy. She said: “The U.S. is embedding the dollar into the next-generation financial infrastructure, uniting monetary strategy, capital markets, and digital technology under a sweeping legislative vision.”

In addition, President Trump has issued an executive order to allow U.S. retirement schemes to include alternative assets, including digital currencies, which Silenskyte expects to unleash a wave of institutional participation.

She highlighted that the GENIUS Act mandates: full 1:1 backing in cash, short-term Treasuries, government money market funds or similar investments for stablecoins; a tiered oversight model, prioritising systemic issuers and bankruptcy protections for stablecoin holders.

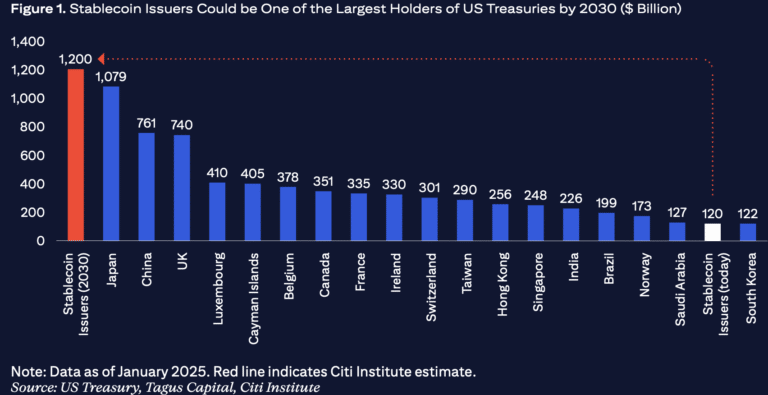

As the stablecoin market grows and with reserves held in Treasuries and similar instruments, Silenskyte said stablecoin issuers will become “demand engines” for the US government debt. Scott Bessent, U.S. Treasury Secretary has cited estimates that stablecoins could grow from $252bn as at 18 July 2025 to $3.7 trillion by the end of this decade.

This will anchor yields, steepen the yield curve and unlock complex fiscal arbitrage opportunities across T-bill auctions, repo markets, or cross-currency trades according to Silenskyte.

“This structural demand could suppress front-end yields and distort rate transmission mechanisms,” she added. “Effectively, stablecoins may evolve into reflexive macro players – buyers of last resort that embed digital liquidity into the sovereign debt machine.”

The Citi Institute has also predicted that stablecoin issuers could become one of the largest holders of US Treasuries relative to any other jurisdiction today.

Silenskyte described the GENIUS Act as “financial Darwinism” as stablecoins become instruments of statecraft, and crypto markets become the new frontier of dollar hegemony.

“It is a systemic upgrade – a dollar-centric redesign of financial infrastructure,” she said. “The US installed programmable, compliant rails to power the next digital economy with enough muscle to marginalise the euro in tokenized finance.”

BlackRock Investment Institute said in a report that the GENIUS Act prohibits stablecoin issuers from paying interest and limits issuance to federally regulated banks, some registered nonbanks and state-chartered firms.

“This regulation could reinforce dollar dominance by enabling a tokenized U.S. dollar-based ecosystem for international payments,” added BlackRock. “Yet in major economies, adoption may be limited by the ban on interest payments, which aims to prevent a low-friction rival that could compete with bank deposits and hurt traditional lending.”

The act also says stablecoin issuers may hold reserves of mostly repos, money market funds and U.S. Treasury bills with a maturity of 93 days or less. The impact on yields will likely be limited according to BlackRock Investment Institute.

“Stablecoin demand for bills is likely to be offset by money shifting from similar assets, so little net new demand,” added BlackRock. “Second, bill issuance is set to keep surging due to the Treasury’s preference to boost the funding of persistent deficits with more short-term debt.”