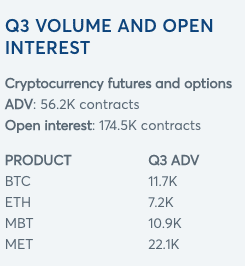

CME Group said average daily open interest across all crypto products was a record in the third quarter of this year, and two thirds higher than in the second quarter.

Open interest in the third quarter reached a combined 174,537 contracts in crypto, 64% more than in the previous three months.

CME highlighted that bitcoin futures average daily open interest reached 13,693 contracts, 18% more than in the second quarter. Ether futures recorded an average daily volume of a record 7,247 contracts, an increase of 10% from the preceding quarter.

What's new in CME Group's cryptocurrency market? Learn more about record open interest in Q3, new products and other market updates in the latest Crypto Insights report. https://t.co/AEDTgmCHnF pic.twitter.com/PXiaWSZipg

— CME Group (@CMEGroup) October 25, 2022

In addition, CME launched ether options on September 12. In August CME introduced bitcoin and ether euro futures to enable traders to access futures on euro-denominated cryptocurrencies, which are the second highest-traded fiat behind US dollars.

In October CME also appointed Giovanni Vicioso as the new global head of cryptocurrency products. He reports to Tim McCourt, who previously led the business and was recently named to the CME Group management team as global head of equity and FX products.

Vicioso joined CME in 2012 as senior director of equity products from RBC Capital Markets’ equity derivatives group.

Crypto exchange volumes

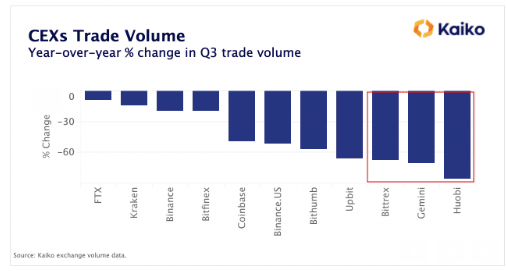

Trade volumes have fallen since 2021 on every exchange analyzed by data provider Kaiko, due to the price of bitcoin dropping to less than one third of its all time high.

“Binance, Coinbase, and FTX – which today are the top three exchanges by trade volume – each experienced lower Q3 2022 volumes, with Coinbase down more than 50%,” said Kaiko. Bittrex, Gemini, and Huobi suffered the sharpest drop in volumes, down 67%, 70.3%, and 85.6%, respectively.”

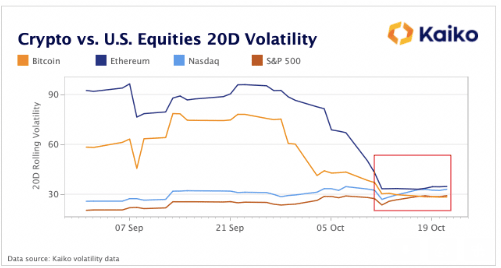

Kaiko also highlighted that bitcoin’s 20-day rolling volatility fell below both the S&P 500 and Nasdaq for the first time since 2018.

“Bitcoin’s volatility more frequently drops below Nasdaq, which contains riskier tech stocks and tends to have a tighter correlation with crypto markets,” added Kaiko. “This has happened before on only a few occasions and typically near a significant local bottom.”