Operating system OpenFin said it has a lot of share to attack in financial services following its latest funding round, despite already having a footprint of 675,000 users.

OpenFin OS enables seamless communication and workflow between apps on a desktop. The firm said the software is now used at more than 3,800 banks, wealth, and asset management firms in more than 60 countries.

Adam Toms, chief executive at OpenFin Europe and global chief operating officer, told Markets Media: “We have a footprint of 675,000 users, but even within the banks there is an awful lot of growing to do. We have a significant number of leading asset managers and wealth managers but there is a lot more for us to attack.”

The software was first used in banks’ markets division but OpenFin is now also used in corporate, wealth and retail banking, which Toms argued are bigger areas of the organisation. Toms said OpenFin has also been used from the front office to back office for quite some time.

In May this year OpenFin announced that it had secured $35m in Series D investment. The latest funding round was led by Bank of America with significant participation from Pivot Investment Partners and ING Ventures.

Toms said: “Growth will come from continued expansion in financial services as we execute on our mission to be ubiquitous across every financial desktop and we are well on our way to doing that.”

He highlighted the announcement in May from the London Stock Exchange Group that it had selected OpenFin’s technology for its LSEG Workspace platform. The group will migrate LSEG Workspace to OpenFin’s zero-install delivery model and container technology, making its platform more easily deployable and interoperable with thousands of internal apps developed by banks and buy-side customers.

Dean Berry, group head of trading & banking solutions at LSEG, said in a statement: “Transforming user experience starts with seamless delivery of LSEG Workspace to customer desktops. Use of OpenFin significantly enhances our delivery model and end user experience, leveraging technology that is already trusted by most global banks and leading asset managers.”

Toms described companies such as LSEG using OpenFin technology as quite formidable and a great milestone. He added: “It is a really significant relationship because their flagship application will be built and deployed on OpenFin technology.”

OpenFin Workspace

In 2021 the firm introduced OpenFin Workspace, the visual interface of OpenFin OS, which the firm said helps unify and simplify the end user experience across both internal and third-party apps to improve productivity and reduce operational risk.

Toms continued that one of the key trends in financial services is the use of OpenFin’s browser technology in Workspace which has reached a large scale as companies feel they can rely on the level of security and performance engineering that exists within the product.

“Security is critically important and our investment is a huge undertaking which requires real resources and expertise,” he added. “Our ability to get ‘zero day’ fixes to customers is a real differentiator with our clients.”

Customers also want immediate insight into interactions with their own end-clients, such as data on outstanding trades and those awaiting confirmation or pending matching.

“Our notifications and alerts can have the biggest impact around T+1 as timeliness will be key,” said Toms. “For example, through our partnership with IPC, a call can trigger an immediate data insight around problems with settling a trade.”

The standard settlement cycle for most US broker-dealer transactions in securities will be reduced from two business days after a trade, T+2, to T+1 on 28 May 2024 in the US and on the previous day in Canada, The US Securities and Exchange Commission said the aim is to reduce latency, lower risk, and promote efficiency and greater liquidity.

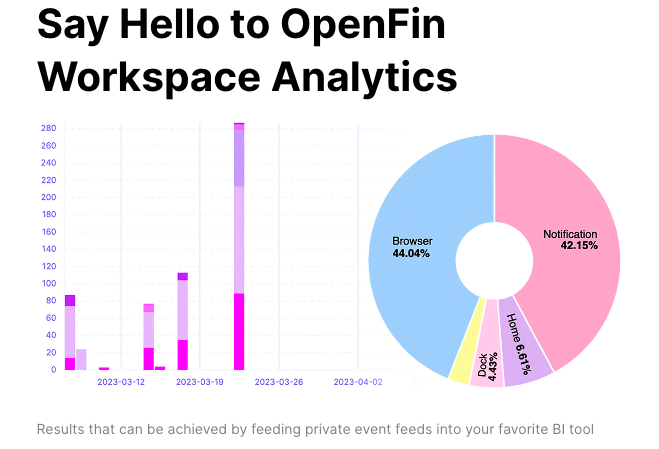

OpenFin has also developed workflow analytics which it makes available to clients via an API, ensuring that none of that information comes back to the software provider.

“Clients can use the analytics to understand the movement of users on their desktop and their needs and applications at a much deeper level which is critical to optimise productivity and workflows,” said Tom. “This is central to OpenFin powering productivity.”

Artificial intelligence

OpenFin has already started to see that clients want the ability to add their own AI experiences into the platform ranging from delivering data insights to being able search different data sources and apps in a more dynamic way.

Toms said: “At our recent event in New York, we had a panel on generative AI which was attended by more than 300 people and followed by one of our partners showing ChatGPT working from OpenFin Home, our search capability.”

Expansion outside financial services

The proceeds of the funding round will also be used to help accelerate the adoption of OpenFin OS beyond the financial industry.

In 2022 OpenFin announced its expansion into the government sector via a strategic partnership and investment from In-Q-Tel, (IQT), who serve intelligence and defence agencies of the US and its allies.

“This is another milestone as the OpenFin product is not being modified to fit this new market, which should be very reassuring for our financial services customers,” added Toms.

Another element of growth is around contact centres across different industries. They are quite phenomenal at measuring productivity and ROI for technology according to Toms, and OpenFin was able to clearly demonstrate its value in both the agent and customer experience.

OpenFin cited multiple surveys that found end users experience between two and four hours of lost productivity each day toggling between apps or searching apps every day. As a result, an organization can lose millions or tens of millions of dollars a year in productivity.

Toms said: “We have different types of customers using our technology in slightly different ways but solving the common problem of too many applications, and data sources which have overwhelmed the desktop.”