BME Exchange, the Spanish trading venue that is part of Switzerland’s SIX Group, has published a white paper on improving Spain’s capital markets and is hoping to make progress on some of the recommendations this year.

Beatriz Alonso-Majagranzas, head of BME Exchange, told Markets Media: “I hope some of the measures in the white paper will make progress this year. Our program is ambitious so it will take time to achieve our goals.”

Some of the changes, such as around taxation, require action from the Spanish government, while others require actions from regulators. However, there are some actions that the exchange can take.

“We will launch new order types and functionalities,” said Alonso-Majagranzas. “It is important that we provide new functionalities, new services, new segments that will help our members and companies, and make our market more attractive.”

Spain needs to boost its capital markets and align the securities industry to the size and potential of its economy according to the white paper. For example, the growth of the Spanish IBEX 35 stock market index has been the lowest (11%) among the benchmark indices of comparable economies since 2013. Over the same time frame, the weight of Spanish listed companies in the European benchmark EURO STOXX 50 index has almost halved since 2013, from 12.3% to 6.5% and Spanish presence in the top 100 Global ranking was lost in 2018.

“In addition, Spain has been the economy that has lost the most weight in the MSCI Blue Book Developed Markets index in the last decade,” added the report.

Alonso-Majagranzas said one of the most important things for both Europe and the Spanish markets is to make the listing process simpler, more flexible, and faster.

“There is a commitment from regulators for changes, which is important, and we are optimistic although change may take time,” she added.

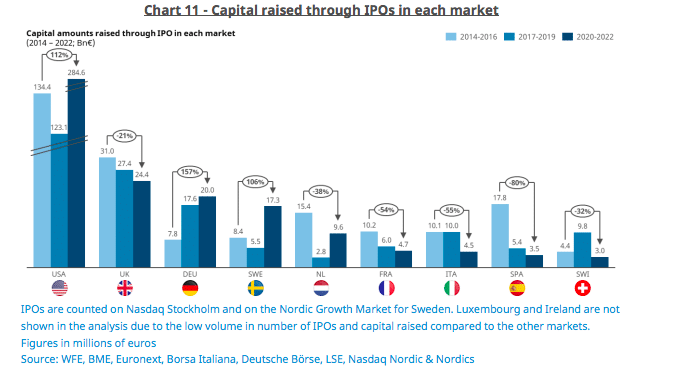

Capital raised through initial public offerings in Spain between 2020 and 2022 fell to a fifth of that recorded between 2014 and 2016 according to the report, which said this was mainly due to the scarcity of medium and large companies joining the Spanish public securities markets.

“This phenomenon is not exclusive to Spain but is more intense for reasons that point mainly to the small average size of its business infrastructure and, in parallel to the complexity and requirements of the IPO processes compared to financing alternatives such as venture capital,” added the report.

Alonso-Majagranzas highlighted that one very relevant point for IPOs is the promotion of the analysis of companies, especially to provide visibility for small and medium-sized enterprises.

BME has an initiative, called Lighthouse, to provide research for SMEs, if they do not have any coverage, through an agreement with the Spanish Institute of Analysts. It is stopped when the company has at least one analyst according to Alonso-Majagranzas.

She continued that BME also has to collaborate with private equity and venture capital so they are part of the process of getting companies listed.

“This is already more visible on BME Growth,” she added.

BME also needs to promote the knowledge of the exchange by companies, especially family-owned companies in Spain, so they know that the market is available, that listing does not mean that they are going to lose control of the company and that it can help them to grow.

“We have introduced the BME Scaleup segment for companies that are smaller and growing,” added Alonso-Majagranzas. “The first company has listed in this segment and we hope to have more in the coming weeks.”

The exchange also has a Pre Market Environment, an acceleration program for the incorporation of companies into the financial markets. On 19 March 2024 BME said it welcomed three new companies to the Pre Market Environment, taking the total to 25 companies in this initiative. From its creation, 41 companies have been trained in the Pre Market Environment, seven of which joined the financial market, the BME Growth more specifically, according to the exchange.

Alonso-Majagranzas said: “We have a very good pipeline of companies intending to list this year, so I hope we will see that come to fruition in the coming months.”

Taxation

BME is asking regulators to shut down the financial transactions tax for bigger companies which is very negative for the Spanish market according to Alonso-Majagranzas. She continued that tax measures that are valid for the startups or smaller companies should also be maintained once they go public so they can continue growing.

In addition, Spanish authorities also need to level the playing field between the taxation of fixed income and equities.

The white paper said there are significant shortfalls in corporate financing through domestic debt issuance. The total volume of fixed income from Spanish issuers has remained stable since 2017 but such issues, especially the larger ones, are preferably made in foreign markets due to the greater ease in terms of requirements and terms of issuance processes.

Alonso-Majagranzas said: “The regulations for bond issues changed last September to simplify the process and we have already seen the effect on new issues.”

In September 2023 Aena, the Spanish airport management group, became the first fixed-income programme to be admitted to trading in Spain after changes in the Spanish securities law. Under the new rule, responsibility for verifying the admission to trading passed from the CNMV, the Spanish regulator, to BME’s regulated fixed-income market, AIAF, making the process more efficient and quicker.

Gonzalo Gómez Retuerto, Head of BME Renta Fija, said in a statement: “This new admission to trading procedure is the result of the close collaboration carried out by the CNMV and BME in recent months to adapt AIAF Market’s regulations to the new law and improve the conditions for issuers to access the capital markets, and is part of the efforts made by both entities to provide the Spanish securities market system with a more agile, efficient and competitive framework.”

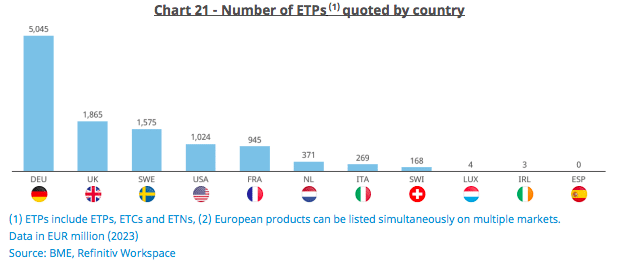

The white paper also highlighted that Spain also lacks a market for exchange-traded products and said the tax rules seem to be an important factor limiting their development.

In addition, the volume of financial futures and options traded in Spain has fallen 39.5% since 2013, according to the white paper.

“These products reflect the breadth and liquidity of the markets and are often widely used by international investors, as well as being indispensable for the management of institutional investors’ securities portfolios,” said the white paper.