The deadline for the end of US dollar LIBOR is in sight when the rate stops being published at the end of next month.

ICE Benchmark Administration and the UK Financial Conduct Authority have confirmed that panel bank submissions for overnight, 1-month, 3-month, 6-month and 12-month USD LIBOR settings will cease at the end of June 2023, although it will be made available on a synthetic basis for fifteen months for use in legacy contracts which are not cleared derivatives.

John Williams, president of the Federal Reserve Bank of New York, said in a statement last month that market participants should already be prepared for the end of June as the final stage of the LIBOR transition draws nearer.

“They should have plans to remediate legacy contracts with new reference rates,” Williams added. “As we think about the future, it is important to remember the lessons of the past and maintain a robust reference rate environment.”

After the financial crisis in 2008 there were a series of scandals regarding banks manipulating their submissions for setting Libor benchmarks, which led to a lack of confidence and threatened participation in related markets. As a result regulators increased their supervision of benchmarks and in 2017 began the process to move to risk-free rates based on underlying transactions, as they are harder to manipulate and more representative of the market. For example, US regulators chose SOFR (Secured Overnight Financing Rate) and the UK chose SONIA (Sterling Overnight Index Average).

Sean Tully, global head of rates & OTC products at CME Group, described the move away from LIBOR as arguably the single largest transition in the industry’s history on the exchange’s first quarter results call. For example, in April this year CME had to convert open interest in eurodollar futures and options into equivalent SOFR contracts.

Tully said: “It’s very clear from the first quarter that SOFR contracts are being used just as intensively and extensively as Eurodollar futures and options ever were.”

In April CME converted 7.5 million contracts of Eurodollar futures and options open interest and $4 trillion in cleared US dollar LIBOR swaps to corresponding SOFR derivatives.

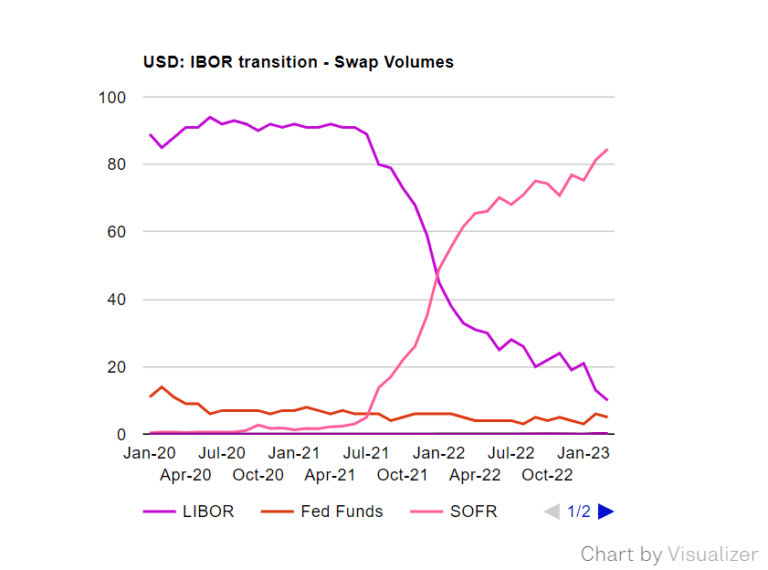

In addition, a record 85% of US dollar swaps referenced SOFR in March this year, according to data from post-trade network OSTTRA. The growth in volume of swaps referencing US dollar SOFR has increased month-by-month since March 2022 when it was 62%.

Kirston Winters, chief risk officer at OSTTRA, said in a statement that the data paints an encouraging picture of the industry’s progress in transitioning away from LIBOR.

“As we saw with the successful departure from IBOR across mainstream markets such as the UK and Japan, the operational burden in delivering this kind of switch is certainly manageable and can even be executed smoothly,” added Winters. “That said, we haven’t reached the finish line just yet – a wide variety of key market participants must continue to cooperate effectively over the coming months, as we enter the final critical stage of this historic migration.”

Scott O’Malia, chief executive of ISDA, said at the derivatives association’s annual general meeting on 10 May that more than 15,800 parties have adhered to the ISDA 2020 IBOR Fallbacks Protocol, and this will be critical for the end of US dollar LIBOR next month.

ISDA’s Ann Battle talks to Tom Wipf @MorganStanley and David Bowman @federalreserve about the countdown to US$ LIBOR transition #isdaagm. Watch the video here https://t.co/iKaARtHzhA pic.twitter.com/urnSSHNawF

— ISDA (@ISDA) May 11, 2023

Issuers need to choose, and communicate, a replacement rate to the investor community before the cessation date for any existing securities maturing after 30 June 30 that currently use US dollar LIBOR. A centralized process to disseminate standardized benchmark replacement details has been developed by the DTCC and the Federal Reserve Bank of New York’s Alternative Reference Rate Committee. Using the DTCC’s Legal Notice System (LENS) allows replacement rate details in a machine readable format to be sent directly to market participants.

Ann Marie Bria, managing director in asset services business management at DTCC, said in a blog: “To ensure readiness, market participants should focus on assessing which contracts are impacted, identify solutions to update the records, and implement changes to ensure compliance with the forthcoming regulatory mandate.”