Stelios Tselikas became head of interest rate derivatives at ICE in October 2023 and one month later the exchange entered the competition for market share in €STR short-term interest rate contracts with CME Group and Eurex, the derivatives arm of Deutsche Börse.

On 1 November 2023 ICE launched €STR Futures which reference the Euro risk-free rate.

Prior to taking on global responsibility for ICE’s interest global rate futures and options markets, Tselikas was head of corporate development for ICE Clear Europe and chief operating officer of ICE Benchmark Administration for about 8 years.

Tselikas described the interest rates complex as an important and strategic business for ICE and said financial derivatives have been at the core of the group’s DNA for quite some time.

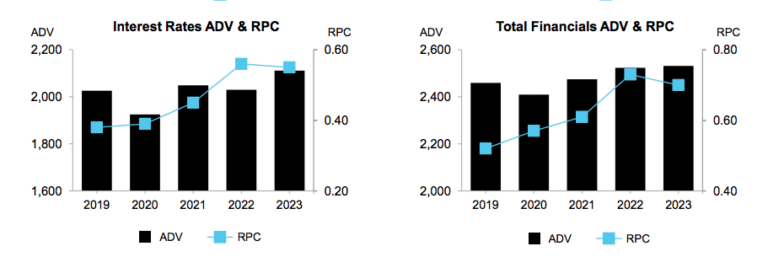

“Average daily volume in our short-term interest rate (STIR) derivatives complex is up 30% year-over-year,” he added.

In January 2024 ICE reported that total financials average daily volume was up 29% year-on-year and open interest rose 14% over the same period.

ICE has traded about 1.33 million €STR contracts since the exchange launched its €STR Futures Liquidity Provider program in November according to Tselikas, and also reached almost 20,000 lots of open interest, which he described as “quite an achievement.

“€STR is a growth opportunity, and we will look at launching an options contract later this year,” he added. “We would like to find the right engagement with clients on when to launch, as we do for all our products.”

Eurex has also said it aims to launch €STR options in the first quarter of this year.

Inter-contract spread

The European Central Bank switched from the former short-term rate EONIA to €STR as part of the regulatory reform which replaced Libor with new risk-free rates that are based on transactions. The ECB began to officially publish €STR on 2 October 2019.

“They used to have Euribor and EONIA and now they have Euribor and €STR and we see those coexisting comfortably together,” added Tselikas. “One is a risk-free rate, the other has a credit element to it so they help investors manage their exposure in different ways.”

Euribor is here to stay and ICE has seen significant growth in Euribor options, as the contracts are a really efficient trading tool when capital is more expensive, according to Tselikas. He said that last December Euribor options traded 1.58 million contracts on a single day, which is ICE’s single highest trading day for over a decade, and open interest in options remains around a 10-year high.

Liquidity in Euribor is important because Tselikas argued that one characteristic that differentiates ICE’s €STR contract is its inter-contract spread, or ICS, to Euribor which has seen increasing volume.

“Users want to have the certainty of expressing a trade with just one click and it is margin efficient,” added Tselikas. “Trading the €STR and Euribor spread at ICE offers a margin offset of more than 90%.”

Another differentiator according to Tselikas is top of book liquidity, which he claimed is two to three times higher at ICE than at other venues.

“It represents the ease in which traders can get in and out of contracts because it reflects the amount that is available to buy and sell,” he said.

Tselikas argued that another important differentiator for ICE is having liquid multi-currency interest rate contracts, especially as capital has become more expensive.

“We have seen this over the past year, which highlights why having liquid multi-currency contracts is an important piece of our offering,” he added. “By trading interest rate derivatives at ICE, customers can both manage their risk efficiently and benefit from margin efficiencies across the complex.”

In addition to Euribor and €STR derivatives, ICE offers Sterling Overnight Index Average (SONIA) and Gilt contracts and Swiss Average Rate Overnight (SARON) contracts.

In the UK, SONIA liquidity improved quite significantly in 2023 according to Tselikas, with average daily volumes up 53% year-over-year and open interest up 119% year-over-year.

“Last December we traded more than 8 million SONIA contracts, which is almost double the December 2022 figures,” Tselikas said. “Confidence is also returning to gilts and open interest is up 50% year-over-year.”

He expects the listed derivatives segment to continue to grow as it is more capital efficient. For example, over-the-counter trading involves a margin period of risk of five to seven days. In contrast, with listed derivatives that risk period reduces to two days, so there is a lower cost of capital.

Competition

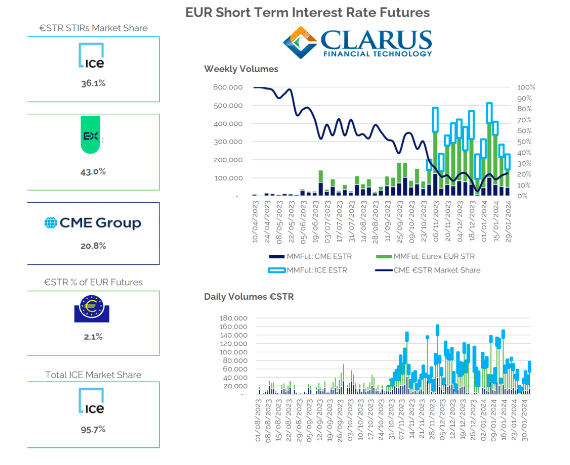

Derivatives analytics provider Clarus Financial said there is still a three-way battle between ICE, CME Group and Eurex for €STR futures.

Chris Barnes at Clarus Financial said in a blog that market share for €STR futures has averaged 17% at CME, 31% at ICE and 52% at Eurex on a weekly basis since December 2023.

“No clear winner has yet emerged for €STR futures, and they remain relatively small compared to the Euribor contract at ICE,” wrote Clarus. “It is worth noting that €STR futures make up between 30-40% of total EUR STIR volumes at Eurex, but only 2-3% of total EUR STIR volumes.”

Clarus noted that open interest has grown at all three exchanges. At the end of January 2024, CME had the largest share of €STR futures open interest at 65% according to Clarus. The blog noted that ICE has seen open interest build up quickly, now making up over 22%, and Eurex has been relatively more stable, at 7,000 to 9,000 contracts.

“For Euribor, open interest at ICE is over 4,000,000 contracts, and the recent activity at Eurex has increased open interest to only around 10,000 contracts,” said Clarus. “It is amazing how much volume needs to trade to even begin to move the needle on open interest.”

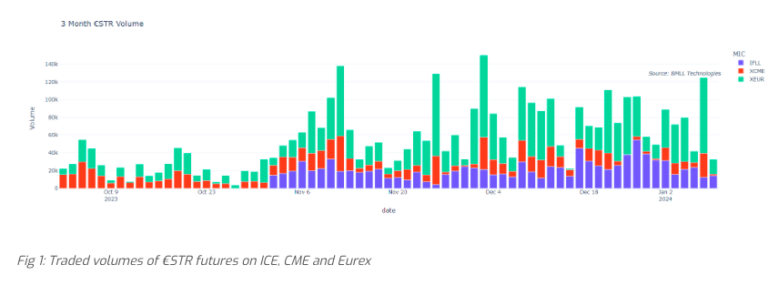

Dr Elliot Banks, chief product officer at data provider BMLL, said in a blog that market participants need to understand the liquidity of €STR futures on ICE, CME and Eurex to minimise the cost of trading, to find liquidity and to hedge efficiently.

“At this point, it is worth noting that Euribor still dominates the overall Euro STIR market, and the majority of liquidity is still on ICE Euribor futures,” added Banks. “This is because, unlike the other benchmark transitions (such as Libor), there is no deadline for firms to transition from Euribor, and the futures contracts have only recently launched.”

However, the growth of the €STR futures suggests that more liquidity will move across to these new contracts.

Banks said of traded volumes: “We can see that, whilst ICE has had a good market share, it has actually raised volumes in Eurex too.”

BMLL continued that, using Level 3 data, ICE has significantly more order book updates than Eurex as participants can trade the inter-contract spread between Euribor and €STR. Firms trading €STR futures on CME can also offset margin against futures on SOFR, the risk-free rate chosen by the US to replace Libor.

A significant portion of the volume is on the inter-product spread according to BMLL.

“By analysing all ICE €STR futures, we find that more than a third of top of book liquidity on the €STR futures comes from implied orders,” added Banks. “Participants are therefore using the inter-product spreads on ICE, which may offer an explanation for the difference in activity between the ICE and Eurex futures.”

Banks concluded that the €STR wars have just begun.