IEX Exchange has updated the Signal, its predictive model that targets adverse price changes, to include new US equities exchanges as well as adapting to increased volatility, volumes and retail trading.

Ronan Ryan, co-founder and president of IEX Exchange, told Markets Media that the goal of introducing the Signal was to essentially predict which way the market will move in order to protect customers from trading at a price that will imminently become stale.

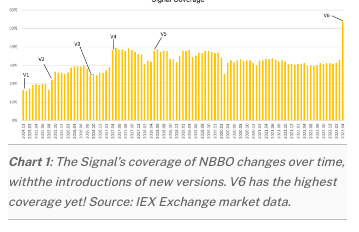

“Version 6 is even more accurate and allows us to effectively cover 60% more adverse moves in the BBO (Best-Bid-Offer), which is pretty remarkable,” he added.

The Signal, also known as the crumbling quote indicator, had previously been updated five times since IEX launched, with the last update introduced in May 2018.

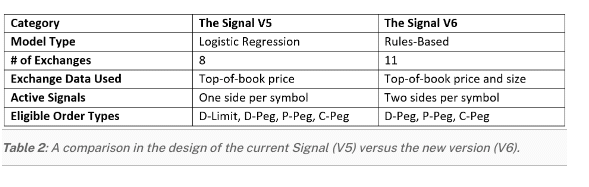

Stan Feldman, chief operating officer at IEX Exchange, told Markets Media that version 6 of the Signal incorporates three additional exchanges – MEMX, MIAX and Nasdaq PSX. He stressed that another important change is that, for the first time, IEX is not just looking at the number of venues, but at the actual size of orders resting at those venues which allows the identification of when markets are likely to change to happen more often.

“The proof will be in the pudding but our intent is to deliver better performance to our clients,” Feldman added. “By paying attention to more factors we can make more predictions, which is why we will continue to evolve the Signal.”

Ryan continued that IEX has got much better at predicting moves in certain symbols because of the functionality of version 6. For example, there may be a bid of 1,000 shares on any of the 11 exchanges covered by the new Signal. Previously the Signal waited for a change in price, but now it factors in degradation in size for its prediction, which can happen in some less liquid or wider spread names.

IEX members can opt in and make the change to version 6 at their preferred pace. Ryan expects a migration over time as some people will choose to adopt both versions, based on their algos and where they are in their order.

“I think there will be pretty broad adoption relatively quickly as when we met with brokers and showed them the data, they were excited for the launch,” said Ryan. “When times are more volatile, the ability to protect quote changes becomes even more valuable.”

Mathematical model

Luke Kowalczyk, head of quantitative research at IEX, said in a blog that version 5 of the Signal predicts 33% of NBBO changes in the volume-weighted average symbol and version 6 predicted 54% of NBBO without sacrificing its true positive rate. changes during the week of 3 to 7 April 2023.

Kowalczyk explained that the mathematical model for the new version of the signal has been updated in three main ways – the logic used to evaluate market data and generate predictions changed from a standard logistic regression to a rule-evaluation format; a layer on top of its rules-based logic monitors each rule’s performance in real-time; and the addition of three venues with additional evaluation whenever either the price or size of any venue’s protected quote changes.

He said: “The result of these changes is a new aggregate statistical model that, like all prior versions of the Signal, is deterministic and reproducible from its market data input. For more detail on the newest model and how it’s being implemented, please see our SEC filing, which includes the formula in full for those interested.”