Nasdaq has launched Eqlipse, the fourth generation of its marketplace technology platform, which Magnus Haglind, head of capital market technology, said provides a number of transformative capabilities.

The Nasdaq Financial Framework was the underlying programme that Nasdaq developed to modernise and build shared technology. Before the Nasdaq Financial Framework was introduced in 2018 the group offered multiple matching engines, clearing and central securities depository (CSD) solutions.

Haglind said: “We have completed this generation of platform modernization and have a number of transformative capabilities in our solutions such as running 24/7 or on cloud.”

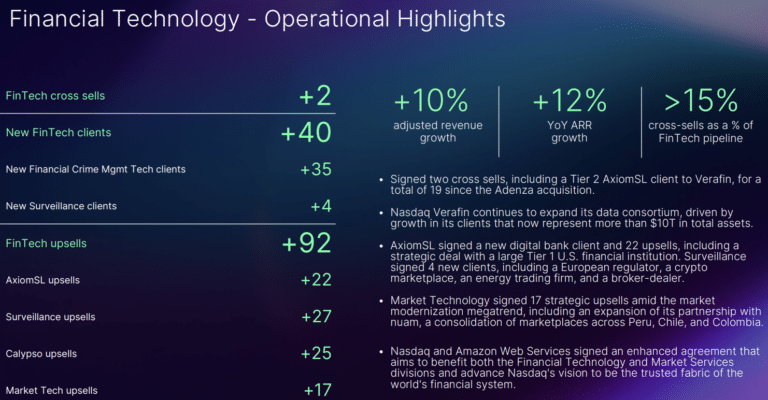

He was recently promoted to head of capital market technology after previously working in the business targeting financial market infrastructure solutions. Haglind now has a broader remit including global connectivity services, market technology and Calypso’s front-to-back trade management solutions. Calypso was acquired by Nasdaq in 2023 when the group completed its $10.5bn acquisition of Adenza, a company formed by the merger of Calypso Technology and AxiomSL, which focuses on regulatory reporting.

Nasdaq Eqlipse includes trading solutions across asset classes, a clearing and risk platform for clearinghouses, and a CSD platform for depositories with high-performing settlement infrastructure. As a result, Nasdaq captures the whole value chain from issuance through price discovery and execution into clearing, risk management, settlement and depositories across asset classes and can also provide a broad array of capabilities such as data management capabilities and managed services. Eqlipse is also introducing an “evergreen” system for quarterly upgrades, allowing clients to keep their solutions up-to-date rather than waiting for major updates every few years.

“The launch of the Nasdaq Eqlipse solution suite marks a new base camp,” said Haglind.

He said clients are most interested in overall modernisation, the capabilities they need to operate and to differentiate their business, and are focused on how they can form technology partnerships to help on that journey. There are many conversations around managed service capabilities and the acceleration of settlement.

Last year the U.S was amongst the markets that cut settlement by one day to T+1, the day following a trade. Europe is aiming to move to the same accelerated cycle in October 2027.

“T+1 means the mission criticality of your solution goes up and organizations are thinking about what they need in order to operate with the same risk profile with much shorter daily cycles to manage,” said Haglind.

Market structure changes such as T+1 and the possibility of trading for 24 hours across five days will force changes to design criteria that were set up 30 years ago, added Haglind.

“More broadly, the industry faces a confluence of many vectors including volatility, more retail coming in, regulation and technology,” he said. “Most market participants have seized the opportunity to adopt cloud and the conversation is now shifting to how to use cloud in a smart way and bring in advanced data management capabilities.”

Cloud

The platform includes Nasdaq Eqlipse Intelligence, a cloud-based data, analytics and reporting platform already used in Nasdaq’s own markets and provides an opportunity for the industry to deploy AI at greater scale. In April this year Nasdaq and Amazon Web Services (AWS) said they would be introducing a new suite of solutions that empower market operators to enhance liquidity, facilitate capital flows, and drive growth, while upholding the highest level of performance, security and resilience.

“We have a very strong conviction that cloud will play an important role for both banks and markets in the next 10 to 15 years,” said Haglind. “We are thinking about how we can combine expertise from the broader Nasdaq group to reimagine our AWS capabilities.”

Johannesburg Stock Exchange, Mexico’s Grupo BMV and Nasdaq’s Nordic markets have all announced their intention to modernize their infrastructure in line with the AWS blueprint.

Leila Fourie, group chief executive of the JSE, said in a statement: “The market infrastructure developed in partnership with Nasdaq and AWS will open the door to greater global market interconnectivity with minimal latency, which will support increased liquidity and capital flows between the US and South African capital markets.”

“History has shown that when you innovate in partnership with the broader industry you can drive genuine transformation,” he added. “This is an ecosystem-oriented business so you need convergence towards a common understanding of where the industry is going.”

Calypso

Haglind said: “We have come to a great position driving market transformation through investment in our infrastructure platforms. We are very proud of that, and we will adopt the same mindset with Calypso.”

He continued that the firm will combine the experience within Calypso with Nasdaq’s experience of designing and running mission critical solutions, and plans to continue evolving some of the architecture, reinvesting in user interface (UI) modernization and expanding the cloud.

“The cool thing about being a market operator is that you constantly invest in your capabilities and capacity as an instrumental part of running mission-critical operations and that is part of our DNA,” he added.

For example, in June this year a record $102.455bn was executed in the Closing Cross on Nasdaq in 0.871 seconds as it was used to rebalance Nasdaq-listed securities in the annual reconstitution of the Russell US Indexes, part of global index provider FTSE Russell. Haglind said overall volumes in April this year following the tariff-induced volatility were multiple factors of the volume spike during the Covid pandemic.

“Regulation helps to ensure sufficient capacity through the system, and every time we hit a new peak we demonstrate that our underlying technology is able to cope with a factor of that volume,” he added.