Will Robos Transform The Wealth Management Industry? (By Camilla de Villiers, Thomson Reuters)

12.03.2015By Camilla de Villiers, Thomson Reuters

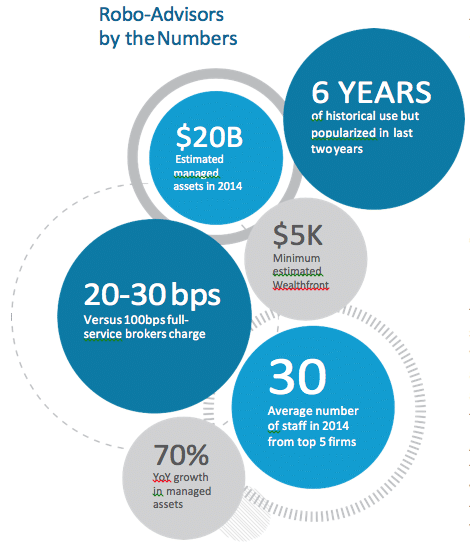

Automated financial advisors, or robo-advisors, have enjoyed a brilliant start off the blocks in their race to disrupt the market for personal wealth management. They attracted an eyepopping $427 million1 in venture capital (VC) funding in 2014 and gathered some $19 billion worth of assets under management on the back of 2013-14 asset growth of 64%. But while their rise has been meteoric, robo assets under management comprise a miniscule .38% of the $5 trillion retail market for financial advice.2 So are robos a harbinger of an imminent “FinTech” revolution that will bring down the big banks or a dot-com-worthy example of supercharged burn rates on a road to nowhere? Their true significance may be an order of magnitude greater than either of these scenarios suggest.

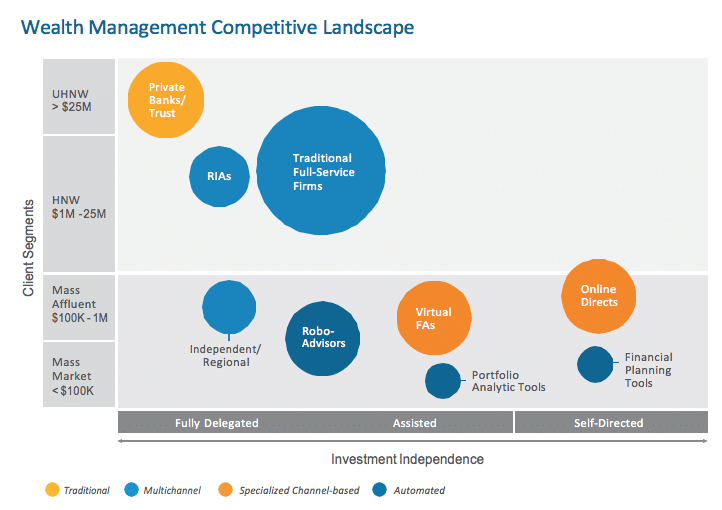

Robos provide basic liability assessment, portfolio analytics, asset allocation/rebalancing and tax loss harvesting (the systematic sale and replacement of money-losing securities to offset taxes on capital gains) for 25-30 basis points in fees, (.25% – .30% of assets under management) plus some 15-30 basis points for underlying funds – a 50% – 75% discount on the 100-200 basis points charged by most traditional advisors. What’s more, most robos offer to manage as little as $5,000 – $10,000, where traditional broker-dealers and registered investment advisors (RIAs) usually can’t afford to service portfolios of less than $500,000 – $1 million. Robos have astutely aimed their services at an underserved, but fast growing, mass affluent market composed of millennial HENRYs (High Earning, Not Rich Yet). HENRYs are 18-34 years old with $50,000 in assets and annual incomes of at least $50,000; they can also be 35+ years old with $50,000 – $500,000 to invest.

The Rise Of Fintech

In considering the rise of robos, it’s interesting to do so in the context of other industry developments. In the 1980s, when simple stock trades could cost up to $100 per transaction, dozens of “discount brokers” rode the wave of commission deregulation to take on Wall Street, morphing into the first Internet brokers. Many are gone, but Schwab, Fidelity, TD Ameritrade, Interactive Brokers and Vanguard are today pillars of the industry, with diversified businesses, intermediated by constantly evolving technology.

Then there was the rise of low-cost Exchange Traded Funds (ETFs). Over the past 25 years, US ETFs have evolved into a $2 trillion3 industry segment. ETF assets today are expanding by 24% per annum – triple the rate of traditional mutual funds.4 Notwithstanding their popularity, ETFs have fallen well short of displacing the $16 trillion mutual fund industry.5 But over the long term, on current rates of growth, mutual funds and ETFs will reach parity at $50 trillion each by 2030.

Discount brokers and ETFs were revolutionary in their time. But there was no revolution. Both have long since intertwined, commingled, gone into business with and been acquired by traditional financial advisors and mutual fund complexes. Today’s robos are only the latest wave of technology and innovation to wash up on the shores of US wealth management. And robos are not alone. While a promising new financial technology, they are but one element of a vast, cloud-centric, mobile-capable, socially driven transformation in progress under the FinTech banner. The 2014 wave of investment in robos comprised only 3.5% of the $12 billion global investment in FinTech that year.6 Innovation is rampant across the ecosystem – not only in wealth management, but also in e-invoicing and payments, crowdfunding, marketplace lending, insurance, risk and security, equity financing, remittances and socially sourced investment research.

Convergence

We are still in the opening acts of the robo story. And the story is moving fast. Traditional financial firms have taken note, and they have moved quickly to embrace the best elements of robo technology and business models.

Few industry analysts believe that independent robos – weighted down with debt and scrambling for assets – will soon find their way to profitability. At the same time, traditional wirehouses and online brokerages are rolling out their own platforms and alliances, acquiring white-labeled robo technologies and even robo advisors in their entirety.

For example:

- Vanguard Personal Advisor services is managing over $17 billion in assets through a combination of algorithmic allocations and human advisors via phone or

- Schwab launched its Intelligent Portfolios robo service using proprietary and third-party

- Fidelity is collaborating with Betterment Institutional Services and offers digital advice from LearnVest through its Institutional Wealth Services The firm also acquired eMoney, a manufacturer of financial-planning software.

- John Hancock acquired Guide Financial, a software firm that uses behavioral finance and artificial intelligence to drive financial

- TD Ameritrade announced an open-architecture robo strategy, focusing on goals and planning in collaboration with third-party

- Capital One Investing will pair algorithms and human advisors with an enhanced investor dashboard aimed at mass-affluent

Bank of America Merrill Lynch – the ultimate traditional wealth management brand – may have a jump on the entire industry. Senior executives in the firm have made open-minded, wait-and-see comments about new robo technologies – and with good reason. The firm’s tech-centric Merrill Edge

platform has been in place since 2010, manages over $125 billion for mass affluent investors, plans to double its advisor headcount to 3,400 in 20167 and is being deployed through Bank of America branches across the country. Adding robo features like algorithmic allocation and automatic tax-loss harvesting to Edge would represent only an incremental enhancement of the digital platform.

Were Merrill Edge to declare itself a robo-hybrid, it would overnight possess a commanding share of the market for automated financial advice.

Disruption

Why would well-established wealth managers with trillions under management voluntarily engage rising technologies and business models that aspire to halve their fees? Perhaps because they believe that an industry transformation toward digital intermediation and lower fees is inevitable. They may perceive robo technologies as the key to lowering their cost of service in reinventing their own business models.

Start-up robos boast of delivering their services for about half the fees of traditional advisors.

According to industry consultants, financial advisors at traditional broker-dealers annually generate an average of $440,000 in revenue,8 serving some 75 clients9 – around $6,000 per client. At the same time, it is estimated that advisors empowered with robo technologies could service between 300 and 500 clients,10 five to six times the traditional model. Start-up robos boast of delivering their services for about half the fees of traditional advisors. If the present-day 50% fee haircut endures, robo-empowered advisory could double or even triple average revenue-per-advisor to between $900,000 and $1,500,000.

At the same time that new technologies are proliferating across the industry, wealth advisory is facing an unprecedented greying of its workforce. The average age of financial advisors in the United States is 50.9, with 43% over 55 and one-third between 55 and 64.11 By contrast, the average age of engineer-developers in Silicon Valley is 28, with 88% under 40 and only 2.4% over 50.12

The productivity gains that robo-advisory seems to promise, combined with the aging of the advisor workforce, suggests that wealth management may soon join other industries in which robots and cloud- based algorithms have massively disrupted business models and displaced the professional work force.

The wealth management industry is alive with discussion of the technological forces roiling around it. But debate about the relative merits of traditional and robo advisory may be short-lived. Traditional wealth managers are deploying robo technologies, upstart robos are partnering with traditional firms and a new category of “robo-advisory hybrid” is emerging. Soon, it may be difficult to distinguish between robo assets under management and the rest. Robos may never displace the wealth management industry, but they are already well along in driving its reinvention

- techcrunch.com/2015/01/27/will-2015-see-the-death-of-the-robo-advisors/

- businessinsider.com/robo-adviser-growth-2014-12

- icifactbook.org/fb_ch3.html

- icifactbook.org/fb_ch3.html

- icifactbook.org/fb_ch3.html

- economist.com/news/leaders/21650546-wave-startups-changing-financefor-better-fintech-revolution?fsrc=scn/tw_ec/ the_fintech_revolution

- investmentnews.com/article/20140904/FREE/140909966/bank-of-america-doubling-down-on-merrill-edge

- cutimes.com/2015/09/02/credit-unions-beat-banks-in-financial-advisor-reve

- fa-mag.com/news/article-1267.html

- investmentnews.com/article/20141221/REG/312219991/robo-advisers-transform-from-threat-to-tool

- fa-mag.com/news/43–of-all-advisors-are-approaching-retirement–says-cerulli-16661.html

- businessinsider.com/silicon-valley-age-programmer-2015-4