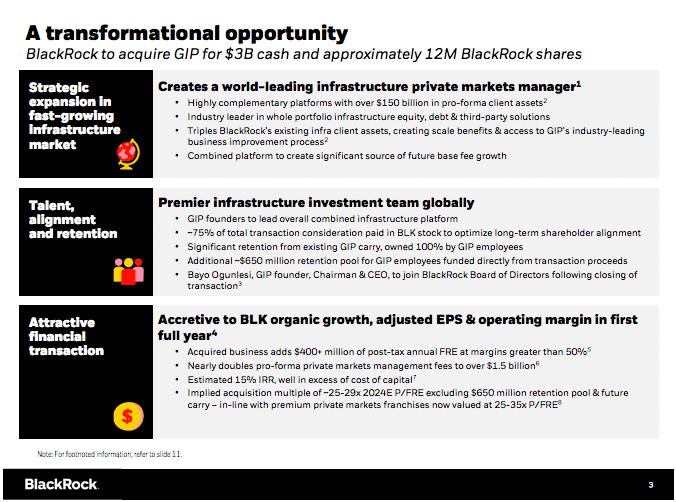

On 12 January 2024, BlackRock announced the $12.5bn of Global Infrastructure Partners (GIP), an independent infrastructure investment platform, which it discussed in its results call for the fourth quarter of 2023. The deal consists of $3bn in cash and approximately 12 million shares of BlackRock common stock, with GIP taking 75% of the consideration in stock.

Bayo Ogunlesi, founding partner, chairman and chief executive of GIP, said on the call: “We are about to enter the golden age of infrastructure, and the question for GIP was how we accelerate what we have done.”

He continued that clients, including pension funds, sovereign wealth funds, asset managers want to invest in high-yielding infrastructure assets, which are also uncorrelated to other asset classes. Ogunlesi highlighted that the average yield on GIP’s mature funds was 8% annually over the last 15 years, despite the low interest rate environment. In addition, infrastructure provides downside protection because the assets provide a central service.

“The marriage with Blackrock is made in heaven,” he added. “The two businesses are very complementary.”

BlackRock has built an infrastructure business which has tripled in size over the last few years from making mid-market investments while GPI invests in large companies. In addition, BlackRock’s business is mostly investment grade while GPI’s deals are usually below investment grade.

“BlakcRock has a couple of solutions business that we don’t have,” added Ogunlesi. “So, if you put these two businesses together, we can go to large and mid-cap clients and offer a complete array of solutions, which allows us to accelerate the rate at which we can provide investment opportunities to our clients.”

Larry Fink, chairman and chief executive of BlackRock, said on the call that the combination with GIP will make the firm the second largest private markets infrastructure manager with over $150bn in total assets under management.

“This is another truly transformational moment for BlackRock and the largest since we acquired BGI nearly 15 years ago,” he said.

BlackRock’s acquisition of the asset management arm of Barclays Bank during the great financial crisis has been described as the deal of the decade. The transaction. propelled BlackRock into top position as the largest asset manager in the world, and gave it the iShares franchise for exchange-traded funds as passive flows have outpaced active.

Fink highlighted that, at the time, most people hated the BGI transaction because they did not understand the need to marry active and passive, and also did not understand ETFs as a technology. When BlackRock acquired BGI, iShares assets were under $300bn and have grown to more than $2.5 trillion.

He continued that BlackRock is taking a long-term view of market forces that will drive outsized growth over the next decade including growing public deficits, a modernising digital world, advancing energy independence and the energy transition, which are driving the mobilisation of private capital to fund critical infrastructure.

“Infrastructure is at the very beginning,” said Fink. “The industrial logic is pretty large and the next 10 years will be greatly about the expansion of global capital markets and infrastructure.”

The GIP acquisition triples BlackRock’s infrastructure assets and will nearly double private market management fees to more than $1.5bn, according to Martin Small, chief financial officer. Small said on the call that demand for private markets remained strong in 2023 with $14bn of net inflows, driven by infrastructure and private credit, which are expected to be primary growth drivers in the coming years.

Fink added that BlackRock only had one acquisition target.

“We only had one organisation where we believed in their business model and only one with such complementary skill sets, he said. “Most importantly, we believe in the team of leaders under Bayo and am pleased he will be joining the board post-closing.”

Kyle Walters, associate analyst, private equity at data provider Pitchbook, said in an email: “BlackRock will acquire GIP, a move set to triple its infrastructure investment unit’s size and enhance its portfolio with more profitable, actively managed products. The purchase price equates to approximately 12.5% of GIP’s assets under management.”

According to PitchBook, this deal marks the ninth of its kind since the start of 2022 as managers look to capitalize on the promising growth outlook in infrastructure.

“Major tailwinds, including the Inflation Reduction Act and Infrastructure Investment and Jobs Act, have helped propel investor interest in infrastructure,” added Walters. “Infrastructure managers were in high demand in 2023 among buyers of GP firms and stakes, led by Bridgepoint’s $1.1bn acquisition of Energy Capital (5.9% of AUM) and Blue Owl’s GP stake in Stonepeak ($55bn in AUM).”

Allocations

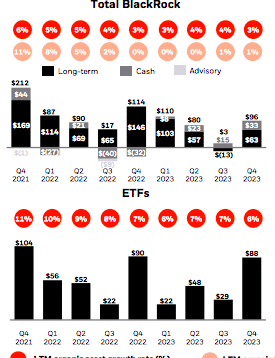

BlackRock reported $289bn of full-year net inflows, including $96bn in the fourth quarter of last year.

Small said flows were positive across active, index, and regions led by $156bn of net inflows from US clients. He said BlackRock has 70 products across the ETF and mutual fund ranges with more than $1 billion in net inflows last year.

Fink said: “We enter 2024 with strong momentum – $10 trillion in assets under management, accelerating flows, and an organization positioned for the future.

Rob Kapito, president of BlackRock, said on the results call: “I wake up every morning salivating about the $7 trillion sitting in money market accounts and that is waiting to move. In order for it to move you need to have a wide plate of products, which we have been developing in clients solutions.”

Kapito continued that a lot of that money will flow into model portfolios and exchange-traded funds, which are becoming the preferred vehicle for investors. Approximately $40bn moved from money market funds to BlackRock last year, according to Kapito, and he expects that to increase once investors feel that the interest rate cycle has ended. Investors will then move into more precision investments, with higher fees, and where yield really matters.

“As we blend the active and passive business together, we are going to see a lot of active fixed income portfolios move into an ETF wrapper,” added Kapito. “That is a huge runway for fixed income and the wind is behind our back.”

Blackrock generated “industry-leading” ETF net inflows of $186bn in 2023, representing 6% organic asset growth, led by $112bn in net inflows into our bond ETFs, added Small.

European ETF industry flows were up 70% year-on-year in 2023 and iShares had almost 50% of flow market share in the region at $70bn. Catalysts in the US such as the growth of fee-based advisors and model portfolios are beginning to take root in Europe.

Small added: “A lot of the long-term trends that propelled the US ETF industry to high growth rates are taking hold in Europe, so this is just the beginning.”

In addition, BlackRock is creating a new international business structure to provide a unified leadership.

“This will allow us to be simultaneously more global, but also more local in fast growing international markets,” said Fink. “We believe in embedding our ETFs and index businesses across the entire firm and that will accelerate further growth of iShares.”

Financials

Revenue of $17.9bn was flat for the full year which Blackrock said was primarily driven by the negative impact of markets on average assets under management, partially offset by higher technology services revenue.

Small saidBlackRock reorganised two of its fastest growing businesses – private markets and Aladdin – in 2023 to stay ahead of clients’ evolving needs. This resulted in a fourth quarter restructuring charge of $61m for severance and accelerated amortisation of previously granted deferred compensation awards.

“In addition, we made resourcing decisions to free up investment capacity for our most important growth initiatives,” said Small. “Overall, these two actions impacted approximately 3% of our workforce.”

Headcount is expected to be broadly flat in 2024.

“We are investing to deliver the industry’s only comprehensive platform across public markets, private markets and investment technology,” said Small. “BlackRock wins share when assets are in motion.”