By Mademoiselle Wanderlust, Markets Media Life Correspondent

As a native of Chappaqua, New York, I have always been fascinated with nearby Manhattan and its neighboring areas. As a former real estate agent once upon a time ago, I can share firsthand the pleasure one receives from matching renters/home owners with their perfect humble abode. Given the thrill of living in a city that has so much (too much?) to offer, the desire to be a resident can go without saying.

Having seen the market fluctuate as it has over recent years is quite interesting, as neighborhoods have been polished off and re-built. There are so few areas left for new construction due to zoning laws and the city appears to be getting smaller. Rental and sales demand seems to only go up, as do prices. And with a sizable contingent of foreign investors on the scene, one can only wonder how many true New Yorkers will have the opportunity to purchase their first home, weekend getaway, pied-a-terre in this highly coveted metropolitan area.

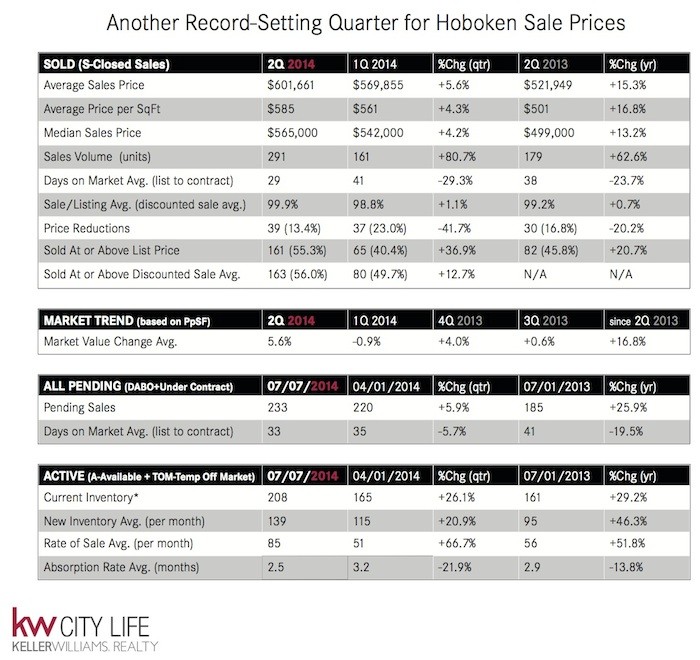

Hoboken Market Overview. Condo & Co-op Sales 2014. Source : Keller Williams Realty

To assess the dream of having a piece of the pie in the sky, I turned to two Keller Williams associates to give us their take on markets in Manhattan and across the river in Hoboken. Welcome, David Wrenn and Natalie Baghdadi.

Mademoiselle Wanderlust: Do you think the impact of foreign buyers will change investment opportunity in Hoboken/JC?

David Wrenn: It absolutely has already impacted the Jersey City and Hoboken markets. Many affluent Chinese homebuyers view China’s economy and its downward trend as an ongoing challenge that will continue to contribute to their investment here. When you couple the economy based challenges in China with its political uncertainty, I fully expect this trend to continue. Chinese homebuyers typically are spending their cash at a higher average price point.

Here are a few links for you to reference to large scale foreign investment in the Jersey City and Hoboken markets….

– Australians investors buying up Jersey City housing

– Chinese firm building 1,000-unit site in Jersey City

MW: What are the average price points for rentals/sales? Is this a buyers/sellers market?

DW: For Rentals in Hoboken and DTJC currently depending on the building type, neighborhood and size we are looking at approximately price for Studio’s $1,600, 1 bedrooms in the low to mid $2,000, 2 Bedrooms are priced in the low $3,000 and mid $4,000 range for 3 beds. Available rental inventory is very low. Saying we are in a seller’s market would be an understatement. (See quarterly reports)

David Wrenn, Keller Williams Realty

MW: How significant are fluctuations from the past decade?

DW: In the last decade we’ve seen dramatic swings in property values. We’ve come full circle from one height to another and in many cases we’ve exceeded the past highs of a decade ago. The return to and exceeded home appreciation values is due largely to the lack of available properties on the market, whereas prior to the crash the home value increase was due to loans being given to unqualified applicants.

MW: How are the foreign investors impacting market value?

DW: Chinese Investors are part of the equation that has been pushing property prices upward in our markets. Foreign investors are typically cash buyers which provides them with significant advantages including not needing to qualify for a mortgage, quicker closing time frames and more leverage in negotiations. Chinese investors see our markets and the real estate found here, as a strong long term investment vehicle. This further reduces available housing for sale, which is already scarce and as a result is driving up prices.

Natalie Baghdadi, Keller Williams Realty

MW: What the market is doing right now?

Natalie Baghdadi: In September, we always see more inventory hit the market. This will start to stabilize with more contracts signed as more people are back in town from the summer break. The market has been full speed ahead! Buyers are rushed to increase offers or come in strong, before losing bidding wars. Sellers are selling for at or above asking price.

MW: How significant are fluctuations from the past decade?

NB: There is definitely a major change in the last 10 years. Toward the end of 2008 is when we saw the sales in Manhattan drop and inventory was up. This continued until about mid-2012 when we started to see the market absorbing the inventory. This is the best year yet – We have been seeing an increase in the past years getting better with each year.

MW: Do you think the impact of foreign buyers will change investment opportunity in NYC?

NB: Yes! Foreign buyers are definitely defeating the opposition — there is a lot of money coming in from overseas. With higher exchange rates, and offer coming in at all cash, it is making it difficult to compete.

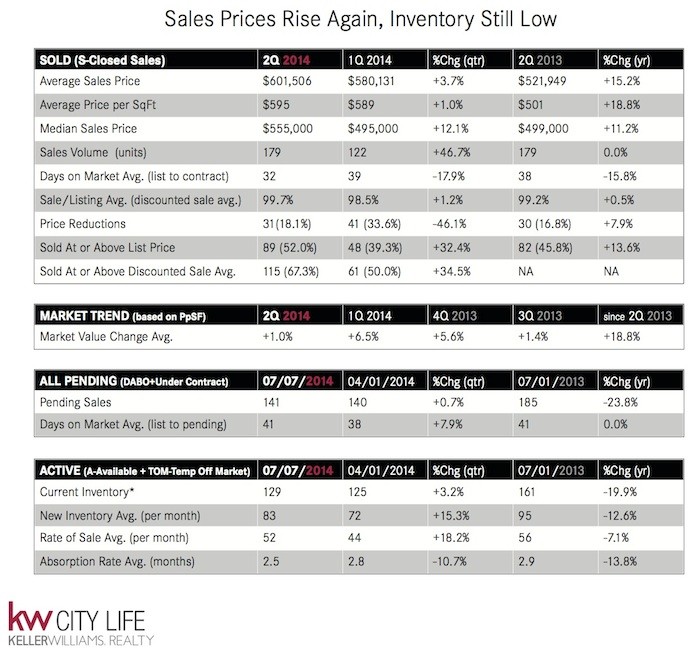

Jersey City Market Overview. Condo & Co-op Sales 2014. Source : Keller Williams Realty

MW: What are the average price points for rentals/sales? Is this a buyer’s or seller’s market?

NB: Currently the overall average price for sales is about $1.6M. Average sales for condos are approximately $2M, for coops around $1.2M, luxury market climbing to around $6M and Townhouses average in the 2nd quarter of 2014 at approximately $4M. For rentals depending on the building type, neighborhood and size we are looking at approximately $2,100 for Studio’s, $2,800 1bedrooms, $3,900 for two beds and $5,300 for 3 beds. The inventory is at an all-time low. We are certainly in a landlord friendly market.

MW: How are the foreign investors impacting market value, etc?

NB: Foreign investors are leveraging the market. They are soaking up inventory resulting in a higher demand.

——

Clearly regardless of where you are located, the demand is only getting stronger. As I’ve lived by the mantra of three words since comprehending what real estate is, nothing has changed: Location, Location, Location!

What would you pay for your slice of heaven here?

Featured image via Natalia Bratslavsky/Dollar Photo Club